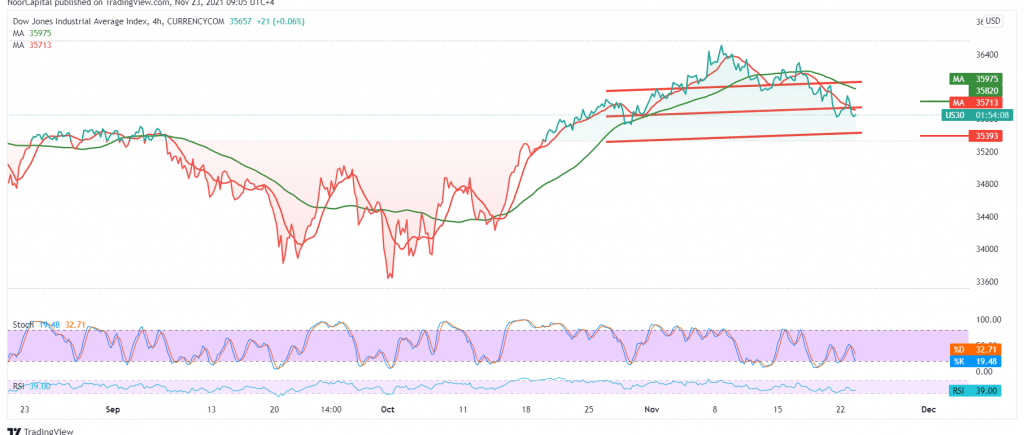

Limited positive attempts witnessed by the Dow Jones Industrial Average during the first trading sessions of this week to hit the resistance level of 35,870, which still constitutes a price obstacle that prevents the index from achieving further increases.

Technically, by looking at the 60-minute chart. we notice that the 14-day RSI is losing bullish momentum, in addition to the stability of the intraday trading below 35,740 and in general below 35,810.

Therefore, the idea of a bearish tendency in the coming hours is valid, targeting 35,460 first target, and breaking it extends the index’s losses to visit 35,320 areas.

The above-suggested scenario depends on the stability of daily trading below 35,810, and its breach will stop the bearish bias immediately, and the index will recover again, targeting 36,020 and 36,160, respectively.

Note: The risk level is high.

| S1: 35460 | R1: 35810 |

| S2: 35320 | R2: 36020 |

| S3: 35110 | R3: 36160 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations