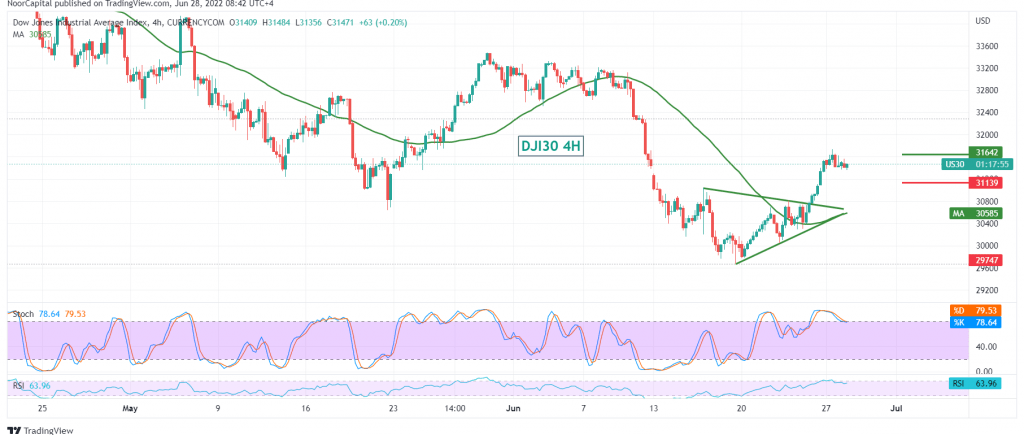

The Dow Jones Industrial Average jumped during the last trading session, recording notable gains, to reach its highest level of 31,691.

Technically, despite the rise that the index witnessed yesterday, the current movements are witnessing a bearish bias with the decline of the bullish momentum, as is evident on the 14-day momentum indicator, in addition to the intraday pivot below 31,600.

Therefore, we may witness a bearish tendency in the coming hours, targeting retesting 31,245 and 31,200, respectively, knowing that the decline below 31,200 is pressing the index to visit 31,090.

Rising again above 31,600, and most importantly 31,630, is able to thwart the suggested bearish scenario and lead the index to achieve gains in the intraday term towards 31850.

The level of risk is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations