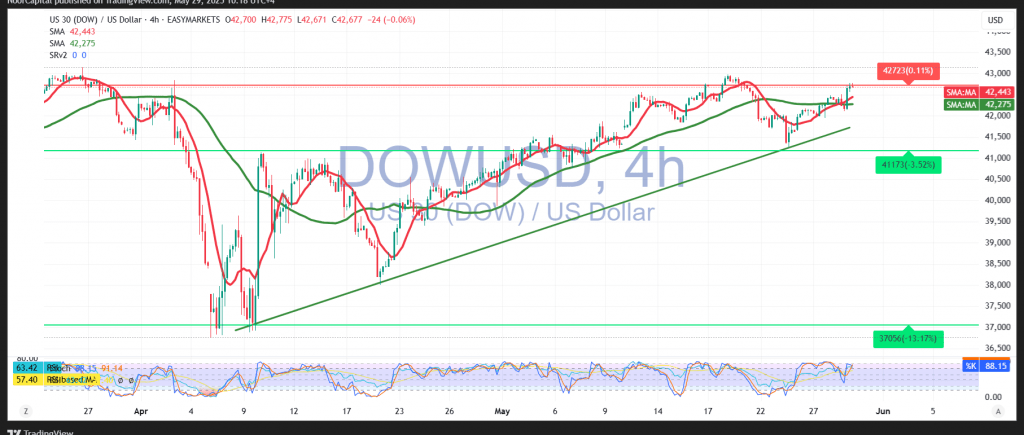

The Dow Jones index advanced strongly within the expected upward trajectory outlined in the previous report, surpassing the first target at 42,590 and approaching the second target at 42,800, registering a high of 42,775 before pausing.

Technically, the Relative Strength Index (RSI) remains stable above the 50 midline, supporting the continuation of the bullish trend. This positive momentum is further reinforced by the simple moving averages, which continue to provide dynamic support and sustain the upward bias.

As long as the index holds above 42,275, the bullish outlook remains favored, with the next target at 42,775. A confirmed break above this level would likely accelerate gains toward the 42,950 mark.

Conversely, a break below 42,275 may temporarily postpone the upward scenario. In this case, a bearish bias could develop, with a potential retest of the 41,860 support level before any renewed upward attempts.

Traders should remain cautious ahead of the release of key U.S. economic data, including Preliminary GDP (Quarterly) and Weekly Unemployment Claims, which are expected to introduce significant market volatility.

Risk levels remain high amid ongoing global trade tensions and economic uncertainties, and traders should remain prepared for sharp market swings in either direction.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations