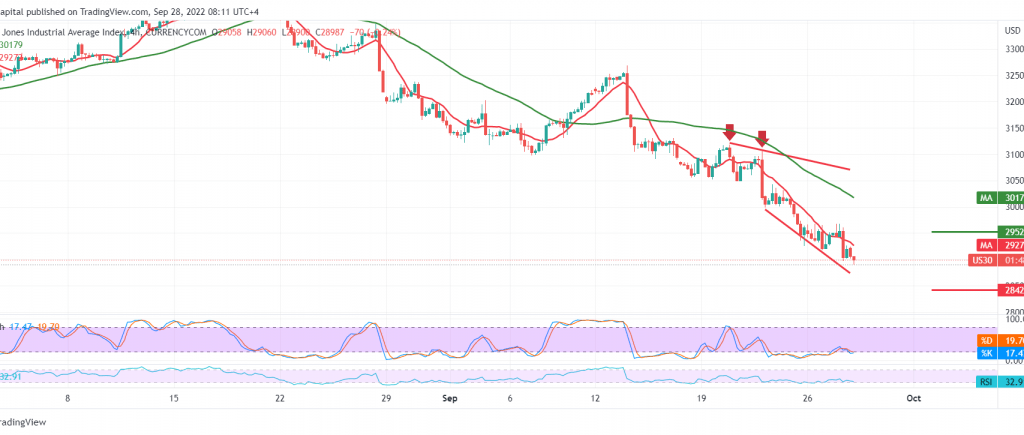

Negative trading continues to dominate the Dow Jones Industrial Average within the expected bearish path, reaching the target at the price of 29,250, to reach the official target station of 29,980, recording its lowest level at 28,944.

On the technical side, with the pivot below the resistance level 29,300, in addition to the RSI’s defense of the bearish trend, stable below the mid-line 50, in addition to the simple moving averages supporting the bearish price curve.

Therefore, the expected tendency for today’s session remains bearish, targeting 28,930 first targets. Knowing that the decline below the mentioned level constitutes strong negative pressure on the index, we are waiting for 28450 next stations.

Activating the proposed scenario requires stability of daily trading below 29,300, and its breach may temporarily lead the index to recover towards retesting 29,510.

Note: Markets are still unstable, and we may see random moves.

Note: We are awaiting the Federal Reserve’s speech later in today’s session, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations