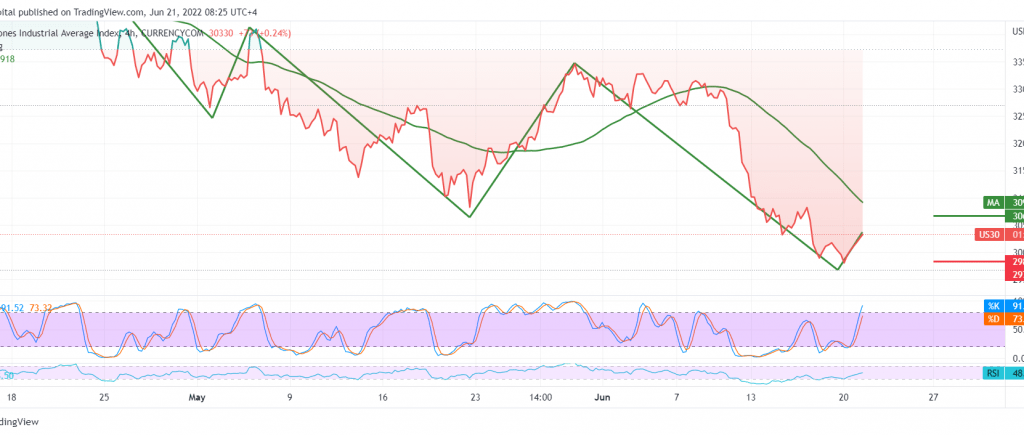

Successive sessions of incurring losses witness the movements of the Dow Jones Industrial Average in the New York Stock Exchange heading to touch the official price station that is required to be touched during the last analysis at the price of 29,660, recording its lowest level at 29,640.

On the technical side today, and by looking at the 60-minute chart, we find the 50-day simple moving average that provides a positive incentive for the indicator. This comes in conjunction with the bullish momentum signs on the RSI and its stability above the mid-line.

Therefore, the possibility of a bullish bias in the coming hours may be effective, targeting the 30,490 first target, considering that consolidation above the target level is a motivating factor capable of enhancing the index’s gains, so we will be waiting for the next 30,590 station.

Activating the proposed scenario requires stability above the support level of 29,850, and a decline below the mentioned level leads the index to complete the bearish directional movement towards 29,420.

Note: the level of risk is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations