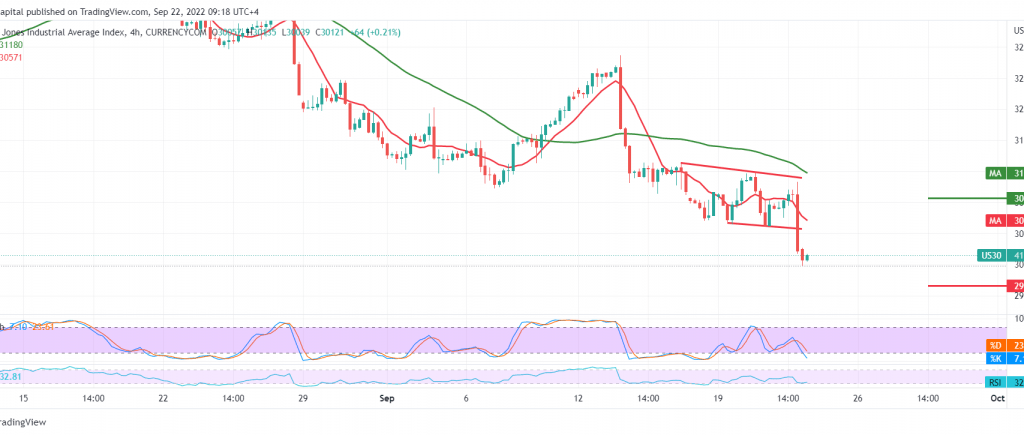

Huge losses dominated the movements of the Jones Industrial Average in the New York Stock Exchange, within the official descending path, as we expected during the previous analysis, touching the official target of 30,180, recording its lowest level at 30,046.

On the technical side today, we continue to decline, relying on the index’s intraday basis below 30,500 and the price stability below the simple moving averages.

Despite the technical factors indicating more declines, we prefer to confirm breaking 30,000 to continue the descending wave to visit 29,790 first target, considering that breaking it leads the index to achieve big losses extending towards 29,400.

A breach up and consolidation above 30,500 may lead to a limited bullish bias, which aims to retest 30,850.

Note: the level of risk is high and may not be commensurate with the expected return.

Note: We are awaiting high-impact data from the UK “British interest rate decision, monetary policy summary, and MPC votes,” and we may see price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations