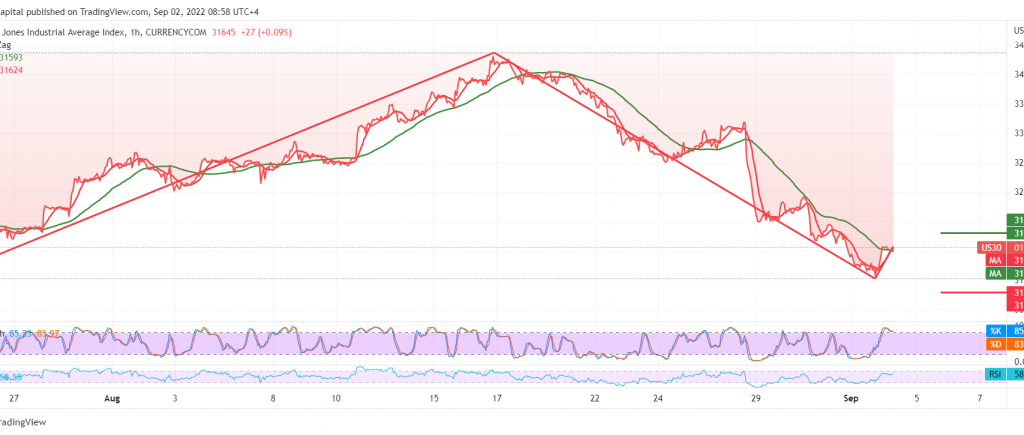

The Dow Jones Industrial Average incurred heavy losses on Wall Street yesterday, touching all the bearish targets published in the previous analysis, approaching the last target 31,195, recording 31,220.

On the technical side today, and on the short time frames, we find the 14-day momentum indicator, which started to provide positive signals and the indicator stable above the 31,380 support level.

We may witness bullish attempts in the coming hours that target retesting 31,810 and we will be satisfied with this initial target only; the slight bullish bias does not contradict the daily bearish trend, whose official targets are located around 30,870 after we witness a clear and strong break of the 31,335 support floor.

Note: The US NFP, unemployment rate data and average wages are due for release today in the USA, and they have a big impact, and we may see price fluctuations; all scenarios are on the table.

Note: the risks are high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations