The Dow Jones Industrial Average retreated in the previous session, snapping a series of consecutive gains as bearish momentum took hold.

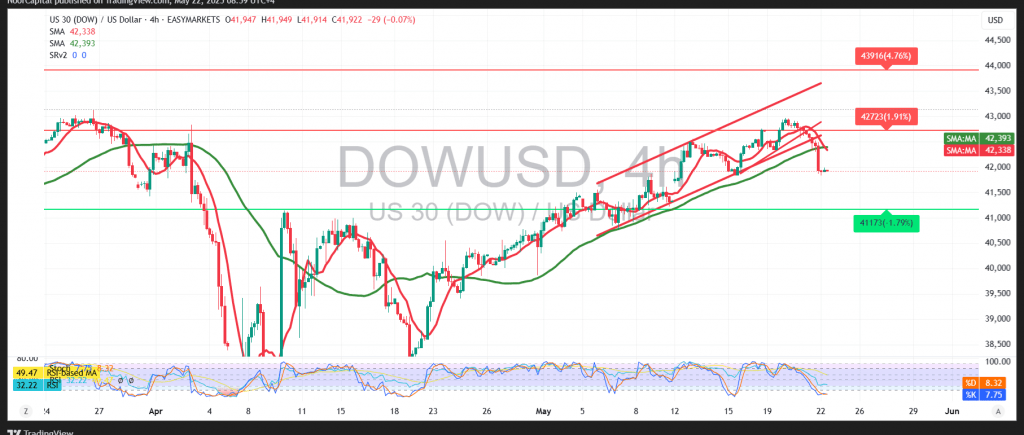

From a technical perspective, the Relative Strength Index (RSI) continues to favor a bearish outlook, holding below the key 50-level. This is further reinforced by the positioning of the simple moving averages, which are applying continued downward pressure—indicating sustained selling interest.

As long as the index remains below the 42,130 resistance level, the downside bias is favored. A clear and decisive break below 41,835 would likely confirm bearish momentum, paving the way for a decline toward the 41,620 support zone in the near term.

Conversely, a breakout above 42,130 and sustained consolidation above this level would challenge the bearish scenario. In this case, the index could stage a recovery, with initial upside targets near 42,445.

Key Event Risk Today:

Traders should prepare for heightened volatility due to upcoming Services and Manufacturing PMI releases from the United States, Eurozone, and United Kingdom—key data that could significantly influence market sentiment.

Risk Disclaimer:

Amid ongoing global trade tensions and sensitive macroeconomic conditions, market risk remains elevated. Traders are advised to manage risk cautiously and prepare for swift directional shifts.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations