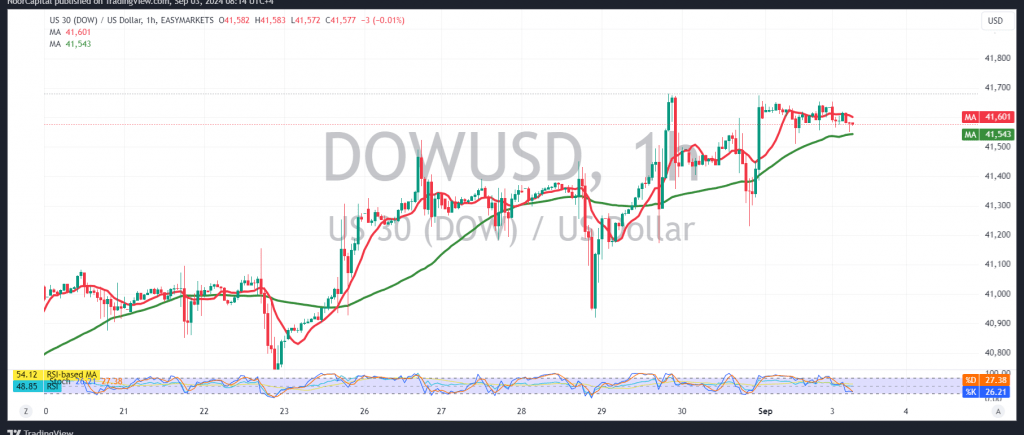

The Dow Jones index posted remarkable gains at the end of last month’s trading, closing positively above the key support level of 41,470.

Technically, today’s outlook leans towards a positive bias, supported by the index’s ability to maintain stability above the 41,470 support level. This is further reinforced by the positive signals from the simple moving averages and the clear bullish indications on the 14-day momentum indicator.

As a result, an upward trend is likely today, with the first target set at 41,650. A break above this level could extend gains, opening the path toward 41,720 and 41,790.

However, if the index falls back below 41,510, it may come under negative pressure, potentially leading to a retest of the 41,430 level.

Warning: The risk level is high and may not be commensurate with the expected return.

Warning: The risk level is heightened amid ongoing geopolitical tensions, which could result in significant price volatility.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations