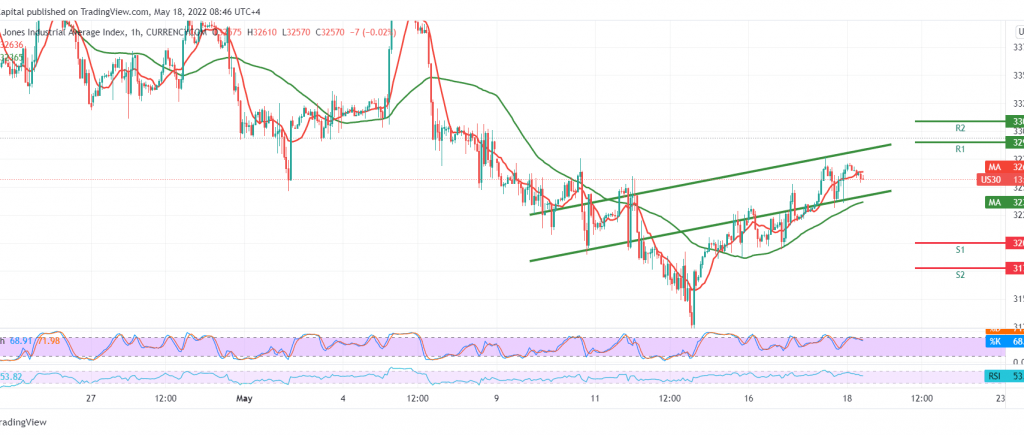

The Dow Jones Industrial Average achieved noticeable gains on Wall Street within the expected bullish context, touching the official target of 32,500, and recording its highest level at 32,690.

On the technical side today, we notice the index consolidation above 32,300, and in general, above 32,260, dictated by stochastic positioning around the overbought areas.

Therefore, the idea of the continuation of the rise is still valid and effective, knowing that the consolidation above 32,550 extends the gains of the index to be waiting for 32,730/32,700 as an initial station, and if it is breached, that increases and accelerates the strength of the bullish bias to be waiting for 32,945 as long as the price of the index is stable above 32,260.

Confirmation of breaking 32,260 is able to thwart the suggested bullish scenario and put the index under negative pressure, with the first target of 32,100.

Note: the level of risk may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations