The Dow Jones Industrial Average posted relatively positive performance in yesterday’s session, snapping a series of consecutive losses and showing tentative signs of a recovery attempt.

Technical Outlook:

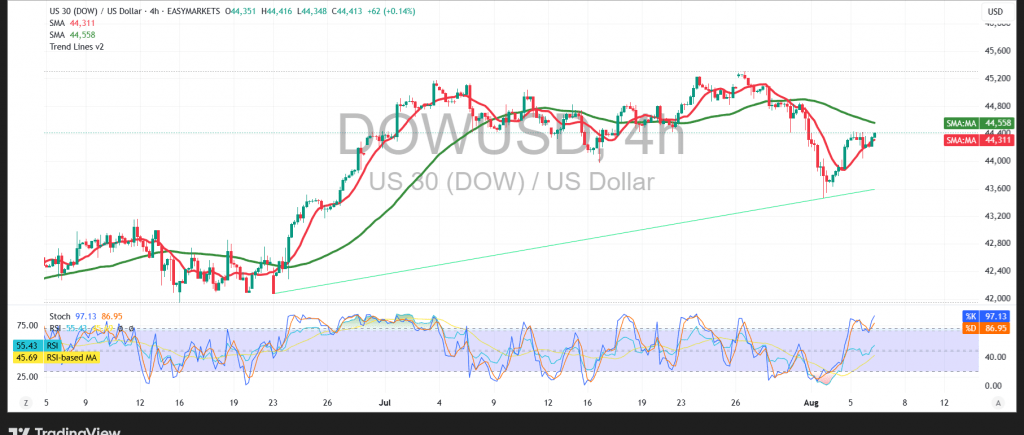

Despite the recent bounce, the index continues to face bearish pressure while trading below key Simple Moving Averages (SMAs), which now act as dynamic resistance zones. However, price stability above the key support at 44,160 improves the likelihood of a rebound, especially with the Relative Strength Index (RSI) beginning to turn upward, suggesting growing bullish momentum.

Probable Scenario:

If the index continues to hold above the 44,160 support level, the recovery outlook will likely remain in play. A move higher could target initial resistance at 44,540. A confirmed break above this level would reinforce bullish momentum, paving the way for a further advance toward 44,670.

Alternative Scenario:

Failure to maintain support above 44,160 may lead to renewed downside pressure. A clear break and close below this level could trigger a decline toward the next key support at 43,910.

Warning:

The market remains vulnerable to elevated volatility amid ongoing trade and geopolitical tensions. Traders should prepare for rapid shifts in sentiment and adopt appropriate risk management strategies.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations