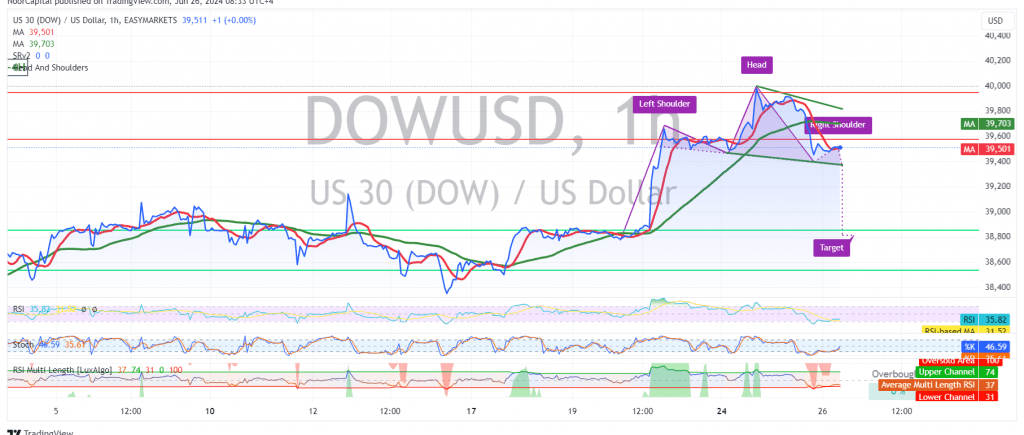

The Dow Jones Industrial Average (DJIA) experienced significant losses, failing to maintain stability above the key 39600 support level, indicating a potential shift in momentum.

Technical Outlook:

On the 60-minute chart, several bearish signals have emerged. The simple moving averages (SMAs) are exerting downward pressure, while the 14-day momentum indicator shows clear negative signals. Additionally, the overall technical structure on the chart has turned bearish.

Downside Potential:

Given these factors, we lean towards a negative outlook, but with caution. As long as the index remains below the 39570 resistance level, a further decline is likely. Breaking below 39395 could open the door for a drop towards the initial target of 39295, with potential for further losses towards 39080.

Potential Reversal:

Traders should be aware that a close above 39570 on the hourly chart could invalidate the bearish scenario. In this case, we may witness a recovery towards 39830.

Key Levels:

- Resistance: 39570, 39830

- Support: 39395, 39295, 39080

Important Note:

The risk level remains high, and potential returns may not be proportional to the risks involved. Ongoing geopolitical tensions could contribute to increased market volatility. Traders are advised to exercise caution and closely monitor market developments.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations