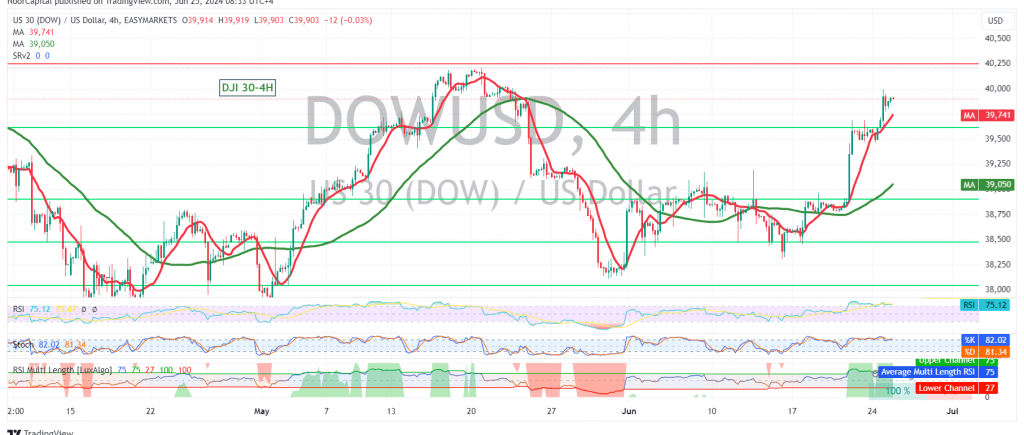

The Dow Jones Industrial Average (DJIA) continued its impressive ascent, reaching our previously identified target of 39910 and briefly touching a high of 39999. The bullish trend remains firmly in place.

Technical Outlook:

On the 240-minute chart, the simple moving averages (SMAs) maintain their positive crossover signals, indicating sustained buying pressure. The Relative Strength Index (RSI) also remains in overbought territory, supporting the ongoing upward trajectory.

Upward Potential:

As long as the DJIA holds above the 39600 support level, the bullish trend remains valid and effective. The key resistance level to watch is the psychological barrier of 40000. A decisive break above this level could accelerate the uptrend, with targets at 40110 and 40310, and the potential for further gains towards 40620.

Downside Risks:

Traders should remain cautious, however, as a close below 39600 on the hourly chart could postpone the upward movement and trigger a bearish correction, potentially targeting 38280.

Key Levels:

- Support: 39600, 38280

- Resistance: 40000, 40110, 40310, 40620

Important Note:

The release of the U.S. Consumer Confidence Index today could induce significant price volatility. Traders should closely monitor the market’s reaction to this high-impact economic data.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations