The Dow Jones Industrial Average (DJIA) continues its upward trajectory, reaching a new high of 40,200.

Technical Outlook:

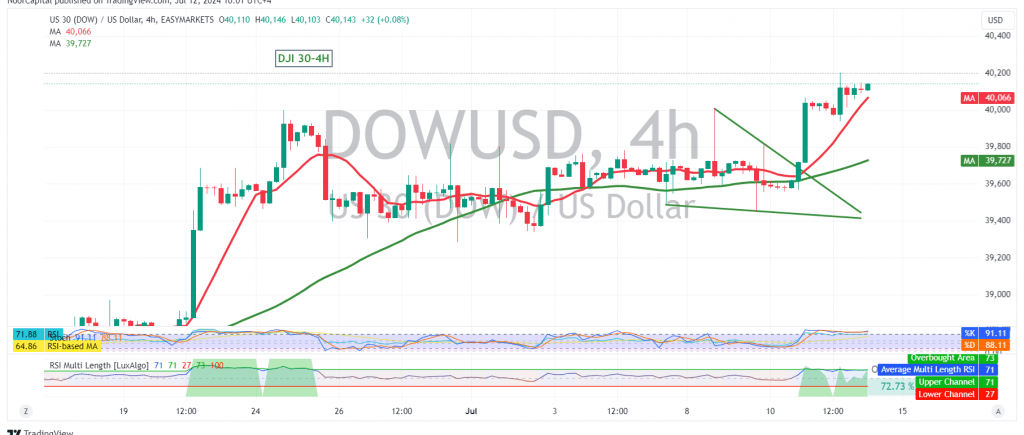

The technical outlook remains strongly bullish. The index is trading above the 39980 support level, with the 50-day simple moving average (SMA) providing positive momentum. Additionally, the Relative Strength Index (RSI) remains in positive territory, further confirming the bullish bias.

Upward Potential:

With the current bullish momentum and solid support, the upward trend is expected to persist. The initial target is 40240, followed by a potential move towards 40290. A break above these levels could lead to further gains towards 40350.

Downside Risks:

However, traders should remain cautious as a close below 39980 on the hourly chart could delay the upward movement and trigger a minor correction, potentially targeting 39850 before the uptrend resumes.

Key Levels:

- Support: 39980, 39850

- Resistance: 40240, 40290, 40350

Important Note:

The release of high-impact U.S. economic data today, including monthly producer prices and the preliminary reading of consumer confidence issued by the University of Michigan, could induce significant price volatility. Traders are advised to closely monitor the market’s reaction to these data releases.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, and potential returns may not be proportional to the risks involved.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations