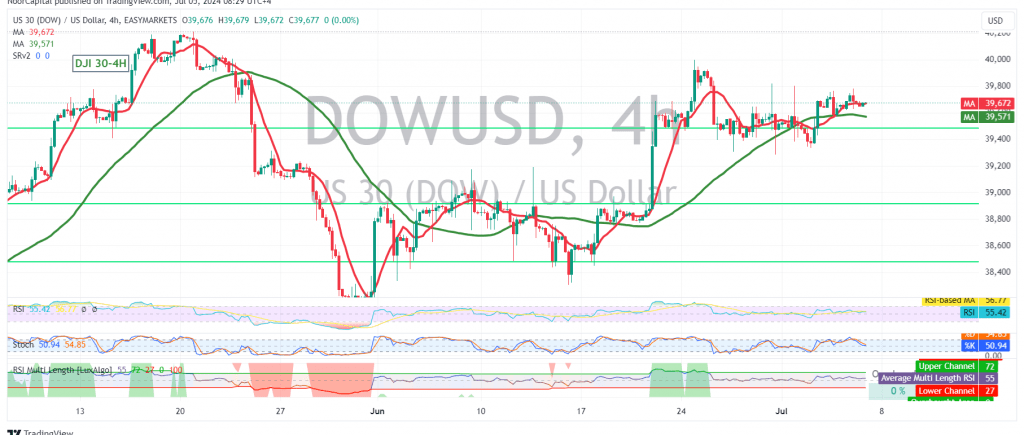

The Dow Jones Industrial Average (DJIA) demonstrated strong positive momentum, reaching a new high of 39,781.

Technical Outlook:

On the 60-minute chart, the index is currently consolidating above the 39550 resistance level, which now serves as a potential support level. The simple moving averages are showing signs of providing a positive impetus, and the 14-day momentum indicator is also exhibiting bullish signals.

Upward Potential:

With the current bullish momentum and the price holding above 39550, a continuation of the upward trend is likely. The initial target is 39780, and a break above this level could accelerate the rally towards 39890.

Downside Risks:

Traders should remain cautious, however. A close below 39550 on the hourly chart could invalidate the bullish scenario and trigger a decline, potentially targeting 39460 and 39360.

Key Levels:

- Support: 39550, 39460, 39360

- Resistance: 39780, 39890

Important Note:

The release of high-impact U.S. economic data today, including non-farm payrolls, unemployment rate, and average hourly earnings, could induce significant price volatility. Traders should closely monitor the market’s reaction to these data releases.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations