The Dow Jones Industrial Average was able to achieve the idea of a downward bias, touching the first target required to be achieved yesterday, which was at 34060, recording its lowest level at 34054.

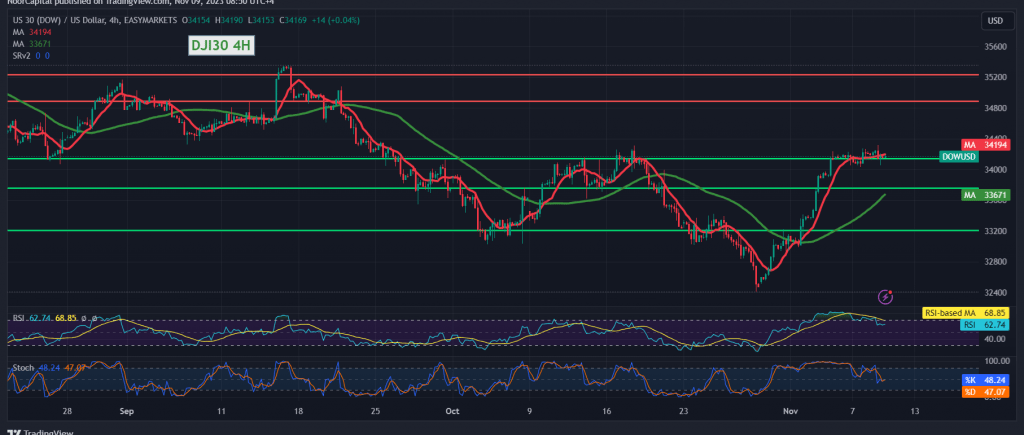

On the technical side, the index achieved an upward rebound as a result of touching the strong support level represented by the target of 34060, to retest 34320. By closely looking at the chart with a time interval of 240 minutes, we find the 50-day simple moving average supports the possibility of a rise, accompanied by the Relative Strength Index’s attempts to obtain positive signals.

We may witness attempts to resume the upward trend, provided the price holds above 34310. This motivating factor enhances the chances of touching 34440, a first target, and the gains may extend later to visit 34540.

From below, the return of daily trading stability below 34060 can completely foil the proposed scenario and put the index under strong negative pressure, with its initial target being 33920.

Warning: Today we are awaiting high-impact press talks, “Federal Reserve Governor Jerome Powell’s talk” and “European Central Bank Governor Christina Lagarde’s talk, and we may witness high price fluctuations.”

Warning: The level of risk is high amid continuing geopolitical tensions, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations