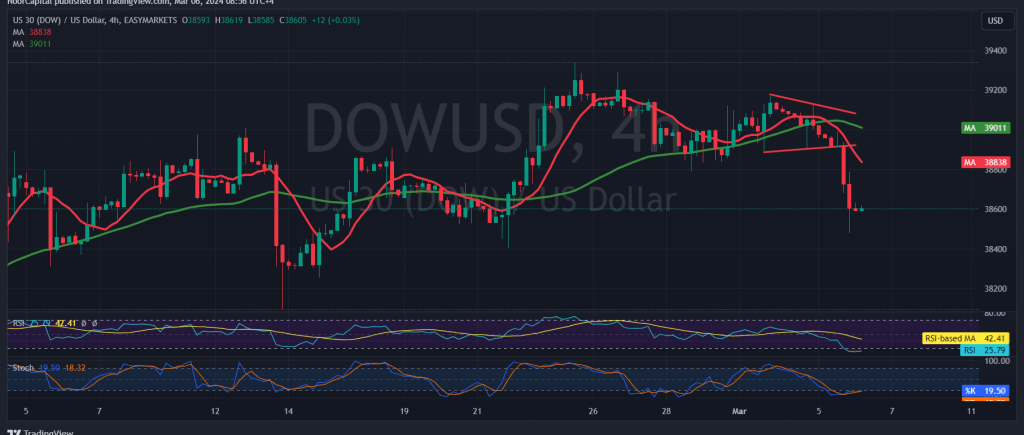

The Dow Jones Index experienced a loss of momentum during trading on the New York Stock Exchange, consistent with the anticipated downward trend. It surpassed the initial target at 38870, reaching its lowest point at 38479.

From a technical standpoint today, we maintain a cautious bearish outlook, with indicators signaling a break below the support level of 38870, which has now transformed into a resistance level. Additionally, the Relative Strength Index continues to support the downward trajectory.

As such, the prevailing bias leans towards further downside movement, with the initial target set at 38390. A breach of this level would reinforce and accelerate the downward momentum, potentially leading to a path towards 38180.

It’s important to note that a reversal above and consolidation of the price beyond 38870 would delay the prospects of a decline. In such a scenario, a retest of 38910 may occur before determining the next price direction.

Warning: High-impact economic data releases from the US and Canada, including changes in private non-agricultural sector jobs, job vacancies, and the labor turnover rate, along with testimony from the Federal Reserve Governor, may result in increased market volatility.

Exercise caution and closely monitor price movements, especially during these news releases. Additionally, geopolitical tensions pose a significant risk, potentially leading to heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations