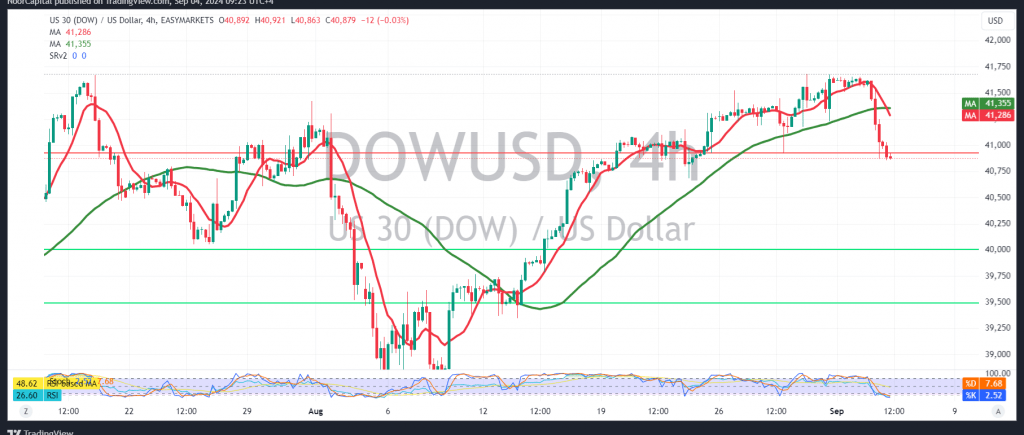

Selling pressure dominated the Dow Jones index yesterday, reversing the anticipated upward trend, which was based on the stability above the 41,510 support level at the time of issuing the report. As noted, a break below 41,510 would put the index under negative pressure, aiming to retest 41,430, ultimately reaching a low of 40,863.

From a technical perspective today, we adopt a cautious negative outlook, driven by the ongoing negative pressure from the 50-day simple moving average and clear bearish signals from the Relative Strength Index (RSI).

As a result, there is potential for a downward trend as long as daily trading remains below the 40,930 resistance level, with an initial target of 40,615.

However, if the index stabilizes above 40,930, it could resume the upward trend, with targets around 41,375.

Warning: The risk level is high and may not be commensurate with the expected return.

Warning: The risk level is heightened amid ongoing geopolitical tensions, which could result in significant price volatility.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations