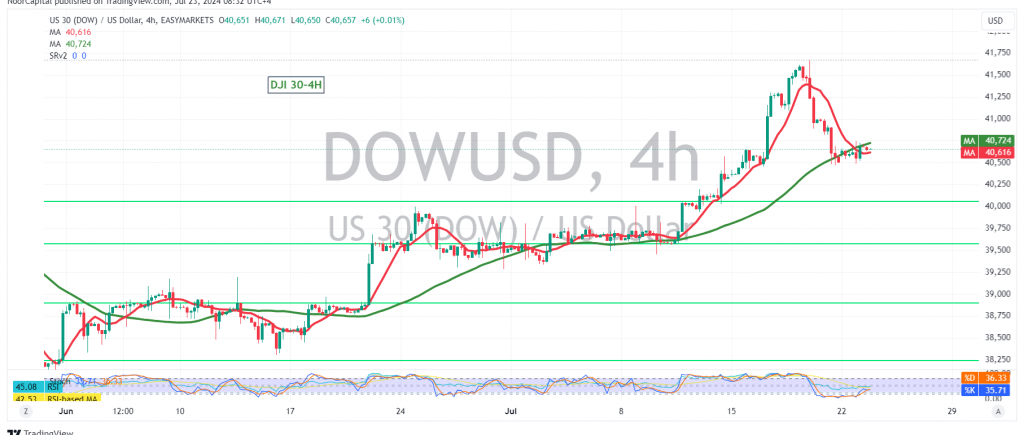

The Dow Jones Industrial Average (DJIA) started the week with a downward trend, reaching a low of 40490 yesterday.

Technical Outlook:

Technical indicators suggest a continuation of the bearish momentum. The 50-day simple moving average (SMA) is exerting downward pressure on the price, and the 14-day momentum indicator is showing negative signals.

Downside Potential:

We anticipate a further decline in the DJIA, with an initial target of 40520. A break below this level could accelerate the downward movement, potentially leading to a test of 40375.

Potential Reversal:

However, a return of trading stability above the 40775 resistance level could invalidate the bearish scenario. In this case, we may witness a temporary recovery towards 40880.

Important Note:

The risk level remains high, and potential returns may not be proportional to the risks involved. Ongoing geopolitical tensions could also contribute to heightened market volatility. Traders should exercise caution and closely monitor market developments.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations