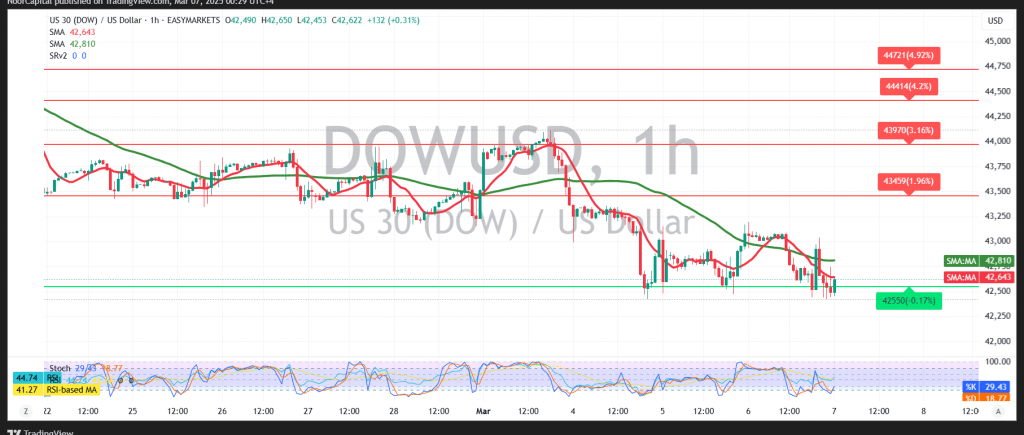

Yesterday, the DJIA fell on the New York Stock Exchange within a bearish context, reaching the first target at 42,490 and recording a low of 42,426.

Technical Outlook

- Conflicting Signals:

- On the 4-hour chart, simple moving averages continue to exert negative pressure from above.

- However, the index managed to close above the support level at 42,430 on a daily timeframe.

- Potential Scenarios:

- Bullish Scenario:

- For an upward trend to materialize, daily trading must remain stable above 42,420, along with an attempt to break through 42,810.

- A successful breakout could pave the way for gains toward 42,970.

- Bearish Scenario:

- Conversely, if the index falls below 42,420, it may initially test 42,300.

- Bullish Scenario:

Risk Warning

Ongoing trade tensions contribute to a high level of risk, and all scenarios remain possible.

Economic Data Impact:

High-impact US economic data—specifically US non-farm payrolls, unemployment rates, and average wages—is scheduled for release today, which could lead to significant volatility.

Market Uncertainty:

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations