The Dow Jones Industrial Average initiated substantial gains at the onset of American trading, aligning with the anticipated upward trend and reaching the initial official target at a price of 38,000, with the highest point recorded at 38,013.

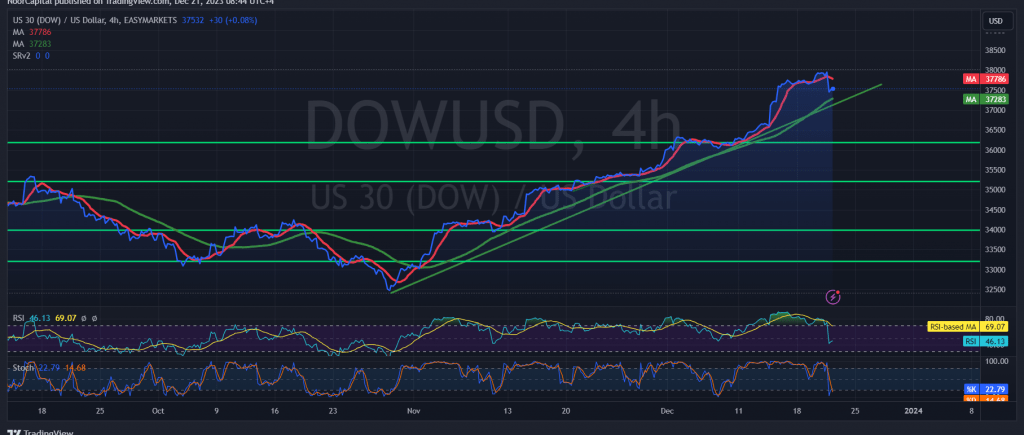

From a technical perspective, the psychological barrier at 38,000 has emerged as a robust resistance level, prompting the index to make some adjustments. Presently, movements indicate stability around 37,530 at the time of this report. A closer examination of the 4-hour timeframe chart reveals that the 50-day simple moving average lends support to the potential continuation of the ascent. Additionally, convergence around the support level of 37,280 adds further strength to this upward trajectory.

In our trading outlook, we adopt a cautiously positive stance. The return of intraday stability above 37,890 is seen as potentially facilitating the path to a visit at 38,265, constituting the initial target. Subsequent gains may extend towards 38,520, representing an awaited official station.

Cautionary Note: The Stochastic indicator signals a tendency towards negativity, suggesting potential price fluctuations until an official direction is established.

Risk Advisory: Today, heightened attention is advised as we await the release of high-impact economic data from the American economy—the “final reading of gross domestic product” for the quarter. Expect increased price fluctuation during the news release.

Geopolitical Warning: The current risk level is high due to ongoing geopolitical tensions, contributing to the possibility of heightened price volatility. Exercise caution.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations