The Dow Jones Industrial Average achieved remarkable gains by the end of last week’s trading, driven by better-than-expected US jobs data, reaching a high of 33,750.

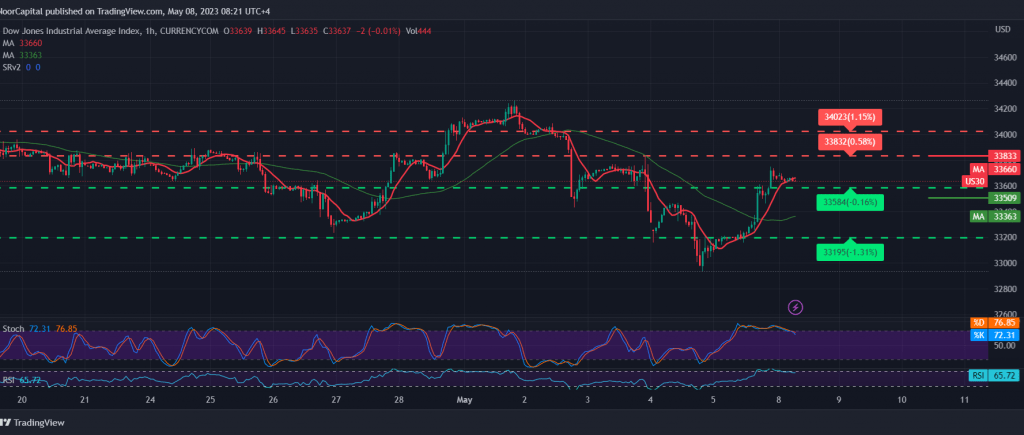

Technically, by looking closely at the 60-minute chart, the simple moving averages have returned to hold the price from below, and this comes in conjunction with the positive momentum signals coming from the 14-day momentum indicator.

From here, with the stability of daily trading above the strong support floor at 33,510, the bullish bias may be the most favorable during the day, provided that we witness a clear and strong breach of the resistance level of 33,690, targeting 33,890 as the first target, and the gains may extend later towards 34,140.

Note: Stochastic is around the intraday overbought areas, and we may witness some fluctuation until the official trend is obtained.

The decline below 33,500 leads the indicator to achieve initial losses, starting at 33,250.

Note: The level of risk is high and may not be commensurate with the expected return, and all scenarios are open to occurrence.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations