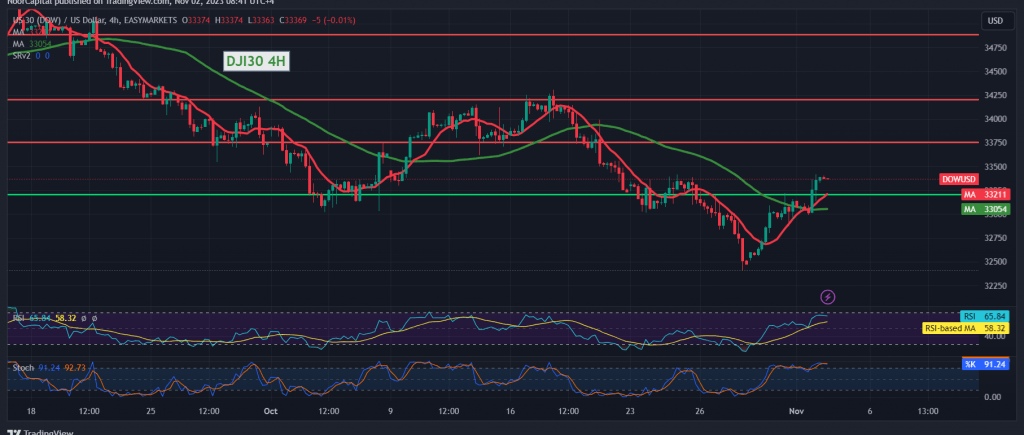

The Dow Jones Industrial Average staged a rebound on Wall Street, registering significant gains as anticipated in the previous analysis, and successfully reaching the first target of 33,405, with the highest level recorded at 33,417.

From a technical perspective today, the trend is inclined towards an upward trajectory, supported by the positive influence of the simple moving averages, guiding the price from below and contributing to the daily upward movement. Additionally, positive signals emanate from the 14-day momentum indicator, further bolstering the positive sentiment.

As long as trading remains above the level of 33,060, the bullish scenario remains the most probable. This is contingent upon a clear breach of the 33,420 resistance level, which could serve as a motivating factor, potentially increasing the likelihood of an ascent towards 33,525. Subsequent gains may extend further towards 33,680.

Conversely, if trading stability falters below 33,060, the index could face negative pressure, with initial targets set at 32,830. Traders and investors should closely monitor these levels to make informed decisions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations