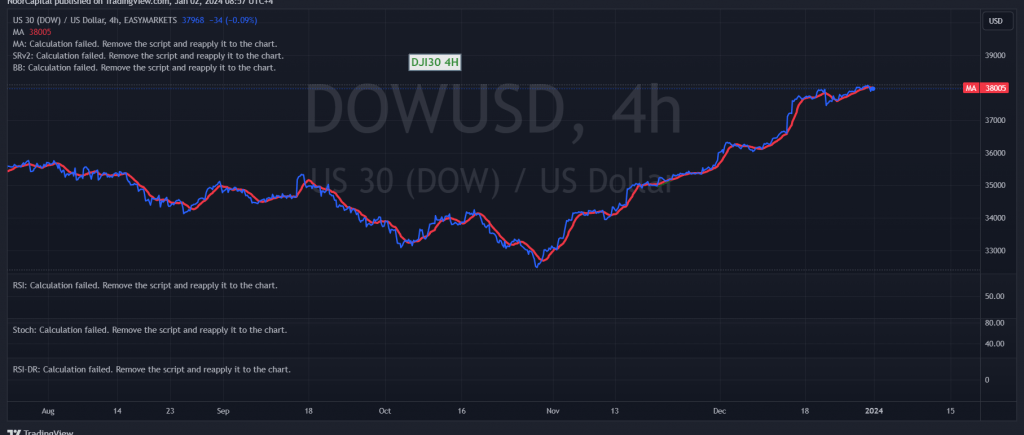

Positive momentum dominated the Dow Jones Industrial Average on the New York Stock Exchange towards the close of last week’s trading, reaching its peak at 38090.

Today, from a technical standpoint and upon closer examination of the 4-hour chart, signs of negativity are emerging on the Stochastic indicator. Furthermore, the indicator is encountering strong resistance at the 38090 level.

There is a potential for a bearish tendency in the upcoming hours if trading remains below 38090, with the initial target set at 37920. A breach below this level could pave the way directly towards 37840.

Conversely, a breakout and consolidation of the price above 38090 would promptly halt the suggested bearish scenario and guide the index towards the official upward trajectory. In this scenario, targets are positioned at 38210.

Traders should exercise caution due to the elevated risk level, particularly in the midst of ongoing geopolitical tensions that may contribute to heightened price volatility. Staying vigilant and adapting strategies to the evolving market conditions is advised.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations