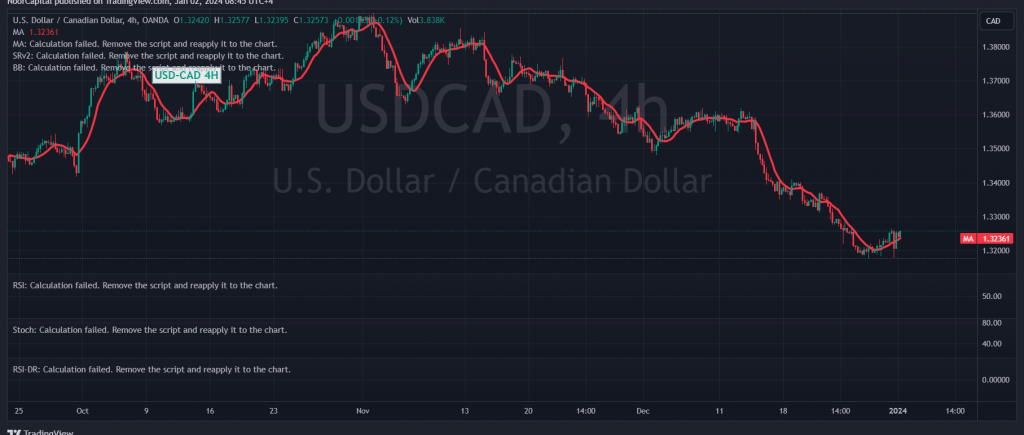

Following several consecutive sessions of decline, the Canadian dollar has discovered a robust support base around 1.3180. Benefiting from this foundation, it is now making efforts to initiate a bullish rebound to the upside.

From a technical analysis perspective today, a closer examination of the 4-hour time frame chart reveals that the Relative Strength Index (RSI) is striving to acquire positive momentum signals on short time intervals. Additionally, intraday trading is maintaining its position above the psychological barrier support level of 1.3200.

As a result, the prevailing outlook leans towards an upward bias, with the initial target set at 1.3285. It’s noteworthy that a breach of this level would pave the way directly towards the 1.3320 mark.

Conversely, confirmation of breaking below the 1.3200 support level would promptly halt the proposed bullish scenario and guide the pair towards the official bearish path. In this scenario, targets are positioned at 1.3145 and 1.3110.

It’s crucial to exercise caution due to the high level of risk, particularly given the ongoing geopolitical tensions that contribute to potential high price volatility. Traders are advised to stay vigilant and consider the associated risks when crafting their trading strategies.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations