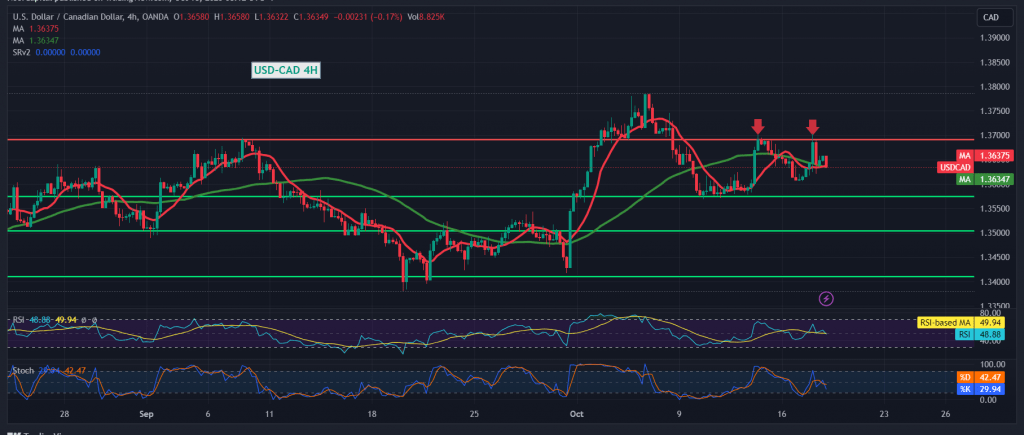

During the previous trading session, the Canadian dollar’s movements witnessed a temporary upward tendency. However, it clashed with the pivotal resistance level at 1.3700 published in the last technical report and failed to breach it.

Technically, the pair found it difficult to break through the resistance of the psychological barrier 1.3700, which forced it to move within the expected bearish context. We find the simple moving averages continuing to put negative pressure on the price, accompanied by clear negative features on the Stochastic indicator.

We may witness a bearish bias during today’s trading session, with 1.3590 as the first target. losses may be extended as we wait for 1.3550 unless we see trading above 1.3700.

From the top, crossing upwards and consolidating the price above 1.3700 will immediately stop the expected bearish tendency and the pair will recover to retest 1.3740 and 1.3770.

Note: The stochastic indicator is near overbought areas, and we may witness some fluctuation before obtaining the official direction.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations