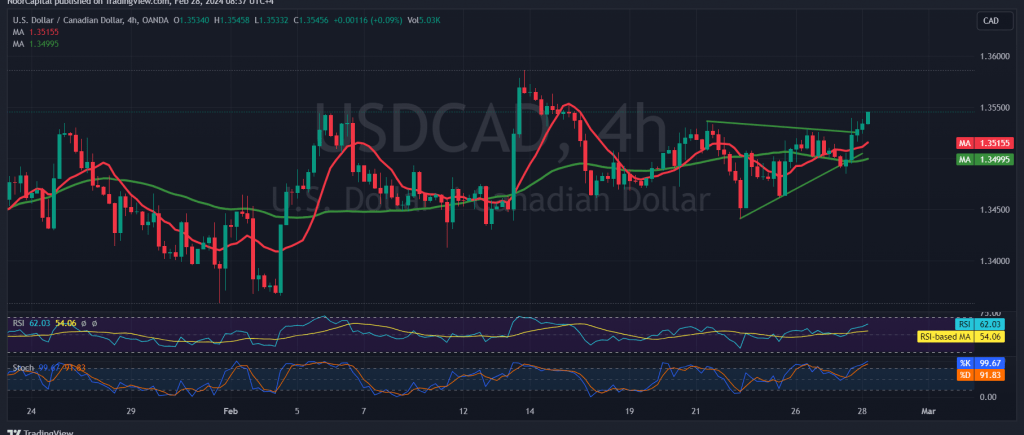

During the previous session’s trading, the Canadian dollar saw a resurgence of upward momentum, leveraging the support level at 1.3480 to initiate an upward rebound, with current levels hovering around 1.3540.

Today’s technical analysis suggests a positive outlook, primarily driven by the reestablishment of stability in the pair’s price above the psychological resistance turned support level of 1.3500, employing the concept of role reversal. Additionally, favorable signals emanate from the 14-day momentum indicator.

In the hours ahead, there is potential for an upward trend to unfold. Notably, breaching the resistance at 1.3565 would serve as a catalyst, amplifying and accelerating the upward trajectory, with targets set at 1.3590 and 1.3620.

Conversely, should trading stability falter below 1.3500, it would invalidate the proposed bullish scenario, exerting negative pressure on the price, with an initial target set at 1.3465.

A word of caution: Today’s trading activity is influenced by the impending release of high-impact economic data from the American economy, particularly the preliminary reading of the gross domestic product – quarterly. Consequently, heightened volatility is anticipated at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations