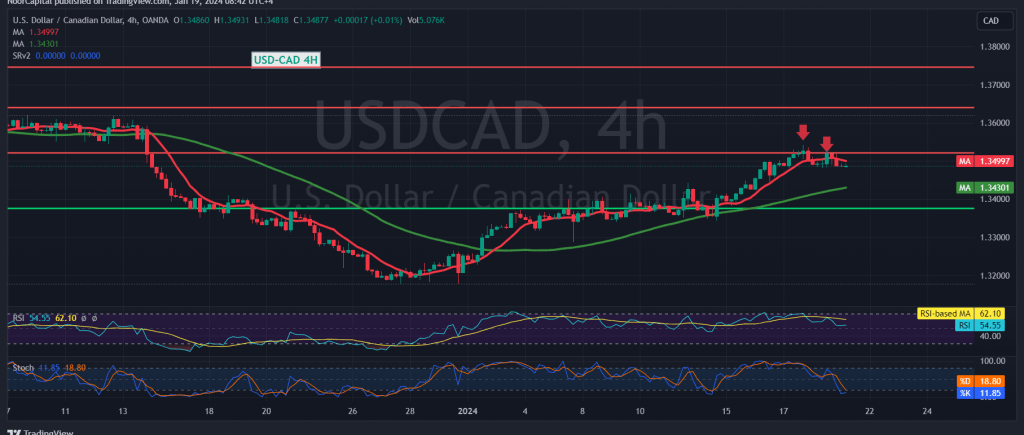

The Canadian dollar displayed a period of calm trading following several consecutive sessions of growth, reaching its highest point around 1.3540, ultimately closing below the psychological resistance level of 1.3500.

Examining the technical aspects today, intraday trading remains stable below the psychological barrier of 1.3500. The 14-day momentum indicator is now providing negative signals, suggesting the potential for downward movements in the hours ahead.

A retracement to levels of 1.3440 and 1.3400 may be witnessed, signaling the initiation of a potential upward rebound. However, it’s important to note that an upward surge and consolidation above 1.3530 would invalidate the retesting scenario, propelling the pair to resume its upward trajectory directly towards the previously analyzed targets of 1.3570 and 1.3600.

Risk Warning: The risk level is elevated, especially amid ongoing geopolitical tensions, potentially resulting in heightened price volatility. Traders are advised to exercise caution and adapt their strategies accordingly.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations