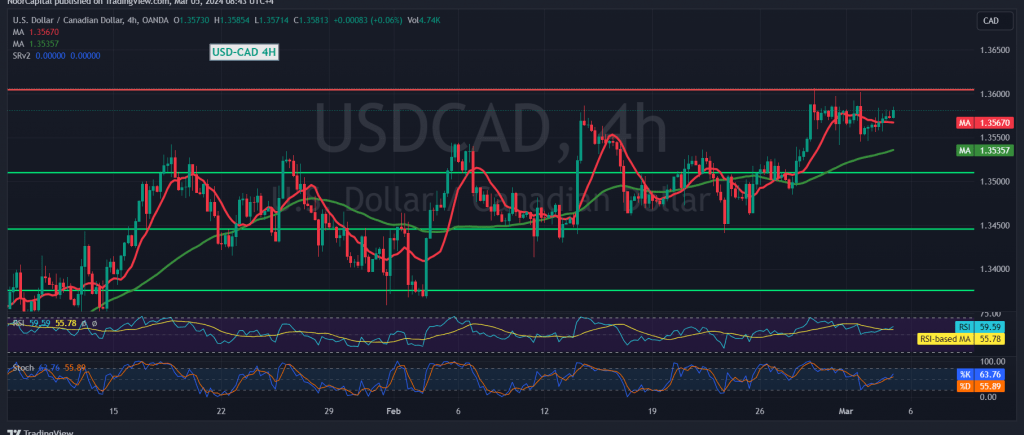

The Canadian Dollar pair has made modest upward attempts, finding support around the 1.3510 level and reaching its peak at 1.3585 during the previous trading session.

In terms of technical analysis today, we cautiously lean towards a positive outlook, contingent upon the pair maintaining stability above the mentioned support level of 1.3510. Additionally, the presence of simple moving averages on the 4-hour timeframe continues to provide a favorable indication.

Hence, the bias remains tilted towards the upside, with an initial target set at 1.3610. A breakthrough above this level could further bolster the upward momentum, potentially leading to targets at 1.3650 and 1.3680.

It’s important to note that a breach below the support level at 1.3510 would invalidate the bullish scenario, subjecting the pair to downward pressure and prompting a retest of 1.3475 and 1.3450.

Investors should exercise caution, especially considering the high-impact economic data expected from the American economy today, particularly the Services Purchasing Managers’ Index issued by the ISM. This release may contribute to heightened volatility in the market.

In summary, while the Canadian Dollar pair exhibits signs of positivity, traders should closely monitor key support and resistance levels and adjust their strategies accordingly, considering the potential impact of upcoming economic data releases.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations