The Canadian dollar experienced positive trades, achieving an upward rebound from the support level near the psychological barrier at 1.2600.

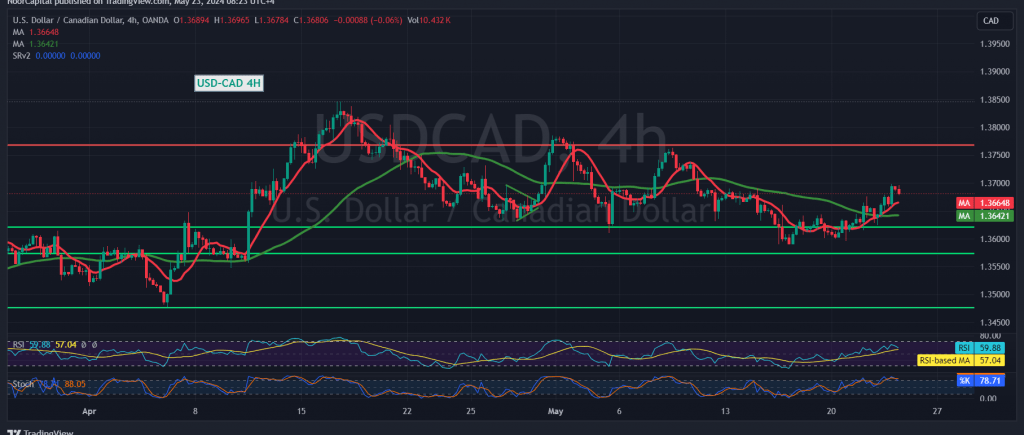

A detailed examination of the 4-hour chart provides several insights:

- Stochastic Indicator: The Stochastic is working to eliminate current negative signals, indicating potential bullish momentum.

- Simple Moving Averages (SMA): Price stability above the SMAs supports a bullish outlook.

Given these indicators, the possibility of an upward trend remains strong as long as intraday trading stays above 1.3630. Key levels to watch are:

- 1.3700: A significant resistance level.

- 1.3710: Breaking this level would likely push the pair towards the next target at 1.3745.

If the price fails to maintain stability above 1.3635, the bullish scenario would be invalidated, potentially leading to a corrective decline towards:

- 1.3590: The first downside target.

Economic Data and Market Volatility

Today’s market may experience heightened volatility due to the release of key economic data from major economies, including:

- France and Germany: Preliminary readings of the Services and Manufacturing PMI indices.

- United Kingdom: Preliminary reading of the Services and Manufacturing PMI indices.

- United States: Preliminary reading of the Services and Manufacturing PMI indices.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations