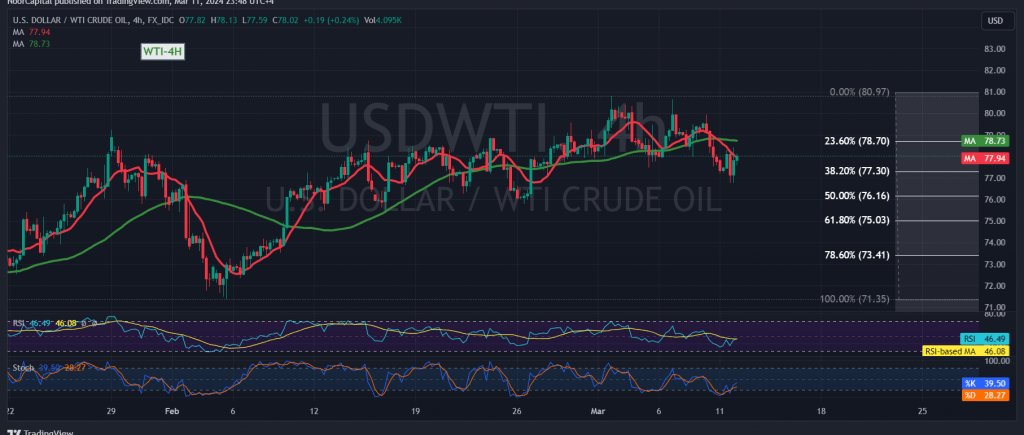

Mixed trading characterized the movement of US crude oil futures contracts in the previous trading session, reflecting attempts to breach the key resistance level at 78.50.

From a technical standpoint, intraday oil price movements indicate a temporary return to stability above 77.80, accompanied by the Relative Strength Index showing tentative signs of positivity. However, strong resistance is encountered around 78.50 and 78.70, respectively, with negative pressure evident on the 50-day simple moving average.

Given these conflicting technical signals, it is prudent to closely monitor oil price behavior, which may unfold in one of the following scenarios:

- Closing below the support level of 77.80 for at least an hour would likely trigger a reactivation of the bearish scenario, with initial downside targets at 77.10 and 76.15.

- Conversely, an upward breakthrough of the 78.70 resistance level would serve as a catalyst for oil prices to recover towards 79.40 and 80.30, marking the next significant resistance levels.

Investors should exercise caution today due to the anticipated release of high-impact economic data from the United States and the United Kingdom, including core consumer prices on a monthly and annual basis (excluding food and energy), as well as monthly and annual consumer prices. These data releases may result in heightened price fluctuation upon their announcement.

Furthermore, it’s essential to acknowledge the elevated level of risk amidst ongoing geopolitical tensions, which could potentially amplify price volatility in the market.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations