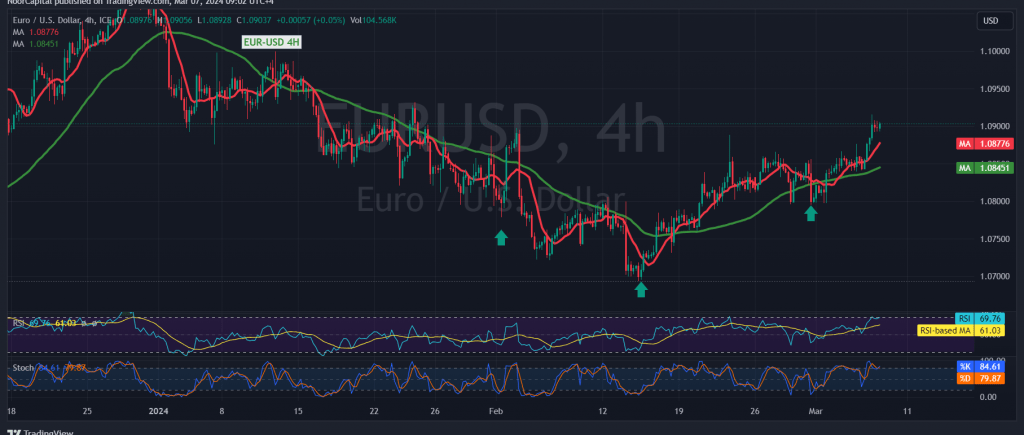

In our previous technical report, we maintained a neutral stance due to conflicting technical signals. We highlighted that the potential for an upward trend hinged on the confirmation of the EUR/USD pair surpassing the resistance level of 1.0860. Such confirmation would likely bolster the pair’s momentum towards 1.0930, with the EUR/USD pair reaching its highest level at 1.0915.

Today, upon closer examination of the 4-hour time frame chart, we observe that the pair has indeed breached the 1.0860 resistance, now acting as a support level, indicative of a role reversal scenario. Furthermore, the moving average has begun to exhibit positive momentum, lifting the price from below, thus reinforcing the possibility of an upward movement.

With the daily trading maintaining levels above 1.0860, the bias towards an upward trajectory is favored for the day, with 1.0930 identified as the initial target, followed by 1.0960 as the subsequent key level, potentially extending towards 1.1000.

It’s important to note that a breach below 1.0860 would reignite bearish sentiment, prompting attention towards 1.0815, with potential losses extending towards 1.0775.

We caution that the Stochastic indicator is signaling temporary negativity, suggesting possible fluctuations until a definitive direction is established.

Furthermore, today’s trading is influenced by high-impact economic data releases, including the Eurozone’s interest rate and monetary policy statement from the European Central Bank, as well as the press conference by the ECB. Additionally, we anticipate the testimony of the Chairman of the Federal Reserve from the United States, which may induce significant price fluctuations upon release of the news.

A word of caution: Today’s trading landscape is punctuated by the release of impactful economic data emanating from the American economy, notably the “Consumer Confidence Index.” Consequently, heightened volatility is anticipated upon the dissemination of this news.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations