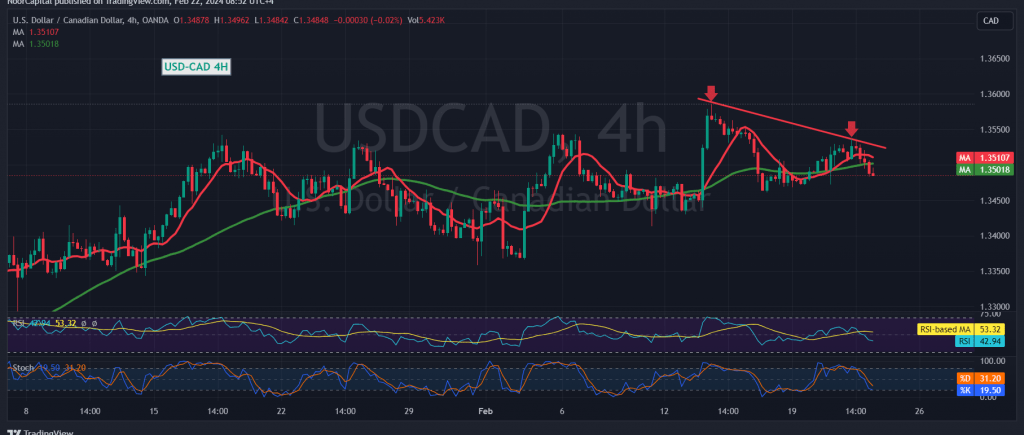

The Canadian dollar faces hurdles in maintaining stability above the psychological resistance level of 1.3500, which serves as a formidable obstacle, constraining bullish momentum.

Technical Analysis Insights

In the current market landscape, a bearish trend unfolds below the critical 1.3500 threshold. A detailed analysis of the 4-hour timeframe chart reveals a shift in sentiment, with the Stochastic indicator signaling negative crossovers and a waning of bullish momentum.

Potential Bearish Bias

Anticipate a bearish bias in the hours ahead, particularly if the pair breaches the 1.3465 level. Such a move could extend losses, opening the path towards 1.3420 and 1.3400, respectively.

Reversal Scenario

Conversely, an upside leap coupled with price consolidation above 1.3540 negates the activation of the bearish scenario. In this scenario, the pair may embark on a recovery journey, targeting 1.3590.

Risk Advisory

Market participants are advised to exercise caution amidst the release of high-impact economic data. Anticipate updates on the preliminary readings of the services and manufacturing PMI indices from France, Germany, and the United Kingdom, alongside key indicators from the United States. Expect heightened volatility during these news releases.

Conclusion

The Canadian dollar grapples with resistance at the psychological level of 1.3500, navigating a complex landscape of technical indicators and market dynamics. Traders should remain vigilant and adapt their strategies accordingly to navigate the evolving market conditions effectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations