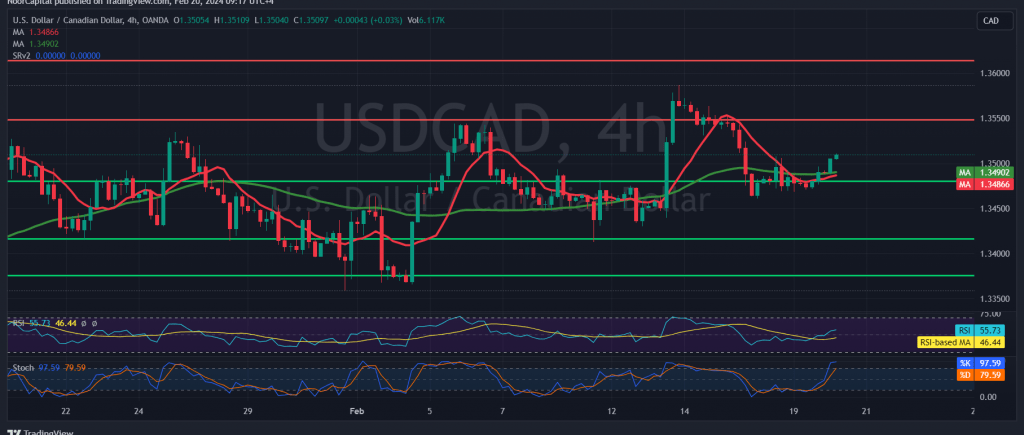

The Canadian dollar displayed strength yesterday with an upward trend dominating its movements, carrying over into today’s trading session with a positive bias. The currency hovers around its morning peak, reaching 1.3510.

Technical Analysis Points to Continued Positive Momentum

Technical analysis indicates that the pair continues to benefit from support provided by simple moving averages, bolstering the potential for further upward movement. This positive sentiment aligns with encouraging signs from the 14-day momentum indicator.

Key Support Level Sustains Bullish Outlook

As long as daily trading remains above the 1.3450 mark, the upward trend is expected to persist. A breach of the 1.3510 level would serve as a motivating factor, increasing the likelihood of further gains towards 1.3540 and 1.3590.

Downside Risks Present with Support Breakdown

However, a close of the hourly candle below 1.3450 would halt the upward momentum, potentially initiating a downward trend with an initial target set at 1.3400.

Risk Warning Amid Economic Data Release and Geopolitical Tensions

Today’s trading session may witness heightened volatility, especially with the release of high-impact economic data from Canada, including inflation figures. Additionally, ongoing geopolitical tensions contribute to increased market uncertainty and potential price fluctuations.

Traders are advised to approach the market with caution, given the elevated risk levels associated with geopolitical tensions and economic data releases. Proactive risk management strategies are crucial for navigating potential fluctuations effectively during this period of heightened uncertainty.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations