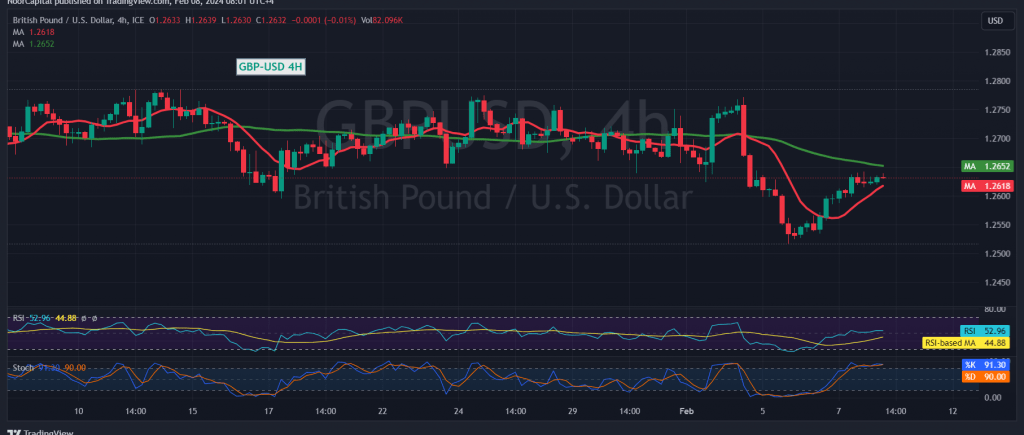

In the previous trading session, the pound sterling exhibited sideways movements vis-à-vis the US dollar, oscillating within a narrow range characterized by a bottom above 1.2600 and a ceiling below the resistance level of 1.2650.

Technical Analysis: Pound Sterling’s Attempt at Establishing a Base

Today’s technical analysis unveils a notable development as the British pound managed to secure a foundational position above the critical 1.2600 level. Furthermore, the Stochastic indicator on the 4-hour timeframe continues its endeavors to capture positive signals, hinting at potential upward momentum.

Anticipated Upward Trajectory and Key Resistance Levels

There exists a possibility of an impending upward trend in the hours ahead, contingent upon the confirmation of breaching the 1.2650 resistance level. Such validation could extend gains, with anticipated targets at 1.2695 and subsequently 1.2730, representing a significant milestone.

Critical Support and Potential Reversal Scenarios

However, it’s crucial to remain vigilant, as a breach below the 1.2600 support level, confirmed by the closure of an hourly candle, could disrupt the envisaged scenario, redirecting the pair towards a downward trajectory. Initial targets in such a scenario are poised at 1.2575 and 1.2550, respectively.

Warning: Exercise Caution Amid Elevated Risk Levels

Traders are cautioned to remain alert, given the high-risk nature of the current market conditions. The anticipated trend requires confirmation, and adherence to prudent risk management practices is imperative.

By staying attuned to critical levels and potential reversal scenarios, traders can navigate the fluctuations within the pound sterling-US dollar pair with heightened precision and confidence.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations