Analysis of Market Movements and Technical Indicators

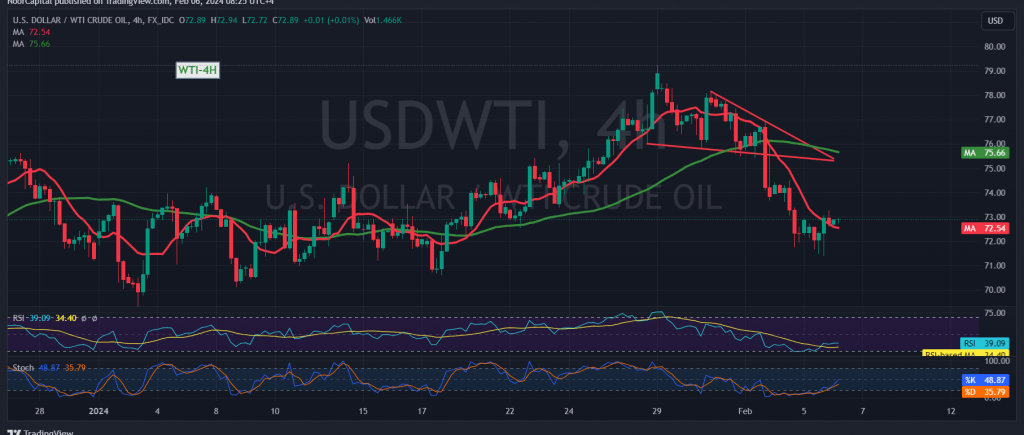

US crude oil futures contracts experienced mixed trading dynamics during the previous session, oscillating between upward and downward movements. The price fluctuated within a range, reaching its lowest point at $71.43 and concluding daily trading at approximately $72.74 per barrel.

Market Dynamics

Mixed Trading Patterns

The price action of US crude oil futures exhibited a mixture of upward and downward movements, reflecting indecision and uncertainty in the market. This oscillation underscores the complex interplay of various factors influencing oil prices, including supply and demand dynamics, geopolitical tensions, and macroeconomic trends.

Technical Analysis

Positive Signs on Technical Indicators

Technical indicators provide some indications of positivity amidst the mixed trading dynamics. The Stochastic indicator on the 4-hour time frame is showing signs of positivity, generating positive crossover signals. Additionally, the Relative Strength Index (RSI) is attempting to signal positive momentum.

Potential Price Movements

Potential Upside Momentum

There is a possibility of witnessing an upward tendency in the coming hours, with a target of retesting the $73.60 level. However, it’s important to note that this upward movement does not necessarily contradict the overarching downward trend.

Downside Targets

Initial downside targets are situated around $71.90. Breaking below this level may strengthen and accelerate the downward trend, potentially leading to a direct path towards $70.70.

Risk Assessment

High Risk Level

Market participants should exercise caution due to the high level of risk associated with ongoing geopolitical tensions and potential price volatility. The unpredictable nature of global events could significantly impact oil prices in either direction.

Conclusion and Tactical Considerations

Navigating Mixed Trading Dynamics

Amidst the mixed trading patterns and technical signals, traders should remain vigilant and adapt their strategies accordingly. Monitoring key support and resistance levels, as well as keeping abreast of geopolitical developments, will be crucial for making informed trading decisions in the volatile oil market. Adhering to risk management principles and staying updated on market news will help mitigate potential risks and capitalize on trading opportunities effectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations