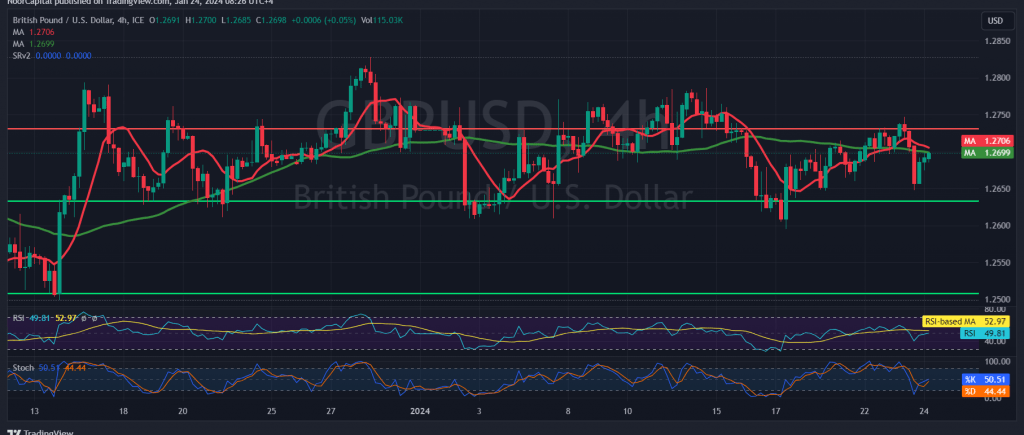

The pound sterling experienced negative trading against the US dollar in the previous session, but the extent of negativity was limited as the pair successfully retested the 1.2650 support level. Current movements indicate stability above this level.

From a technical perspective today, there is a leaning towards positivity in trading, albeit with caution. This assessment relies on the price’s consistency and stability above the 50-day simple moving average. Additionally, positive signals from the Stochastic indicator may provide the impetus for the pair to move higher.

In light of these technical factors, an upward bias is deemed more likely. However, confirmation would be sought through a clear and robust breach of the main resistance level for the current trading levels at 1.2730. Such a breakthrough would extend the pair’s gains, with potential targets at 1.2780 and 1.2820, respectively.

It is crucial to note that a return to trading stability below the robust support level of 1.2650 could lead the pair into a downward trend toward 1.2550.

Investors are advised to exercise caution today as high-impact economic data is expected from the American, French, and German economies, including preliminary readings of the services and manufacturing PMI indices. Furthermore, the preliminary reading of the services and manufacturing PMI index from Britain and the Canadian interest rate decision, along with the Bank of Canada press conference, are events that may contribute to increased volatility in the market.

Cautionary Notes:

- Risk Level: High

- Geopolitical Tensions: Ongoing geopolitical tensions may contribute to high-risk conditions and increased price volatility.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations