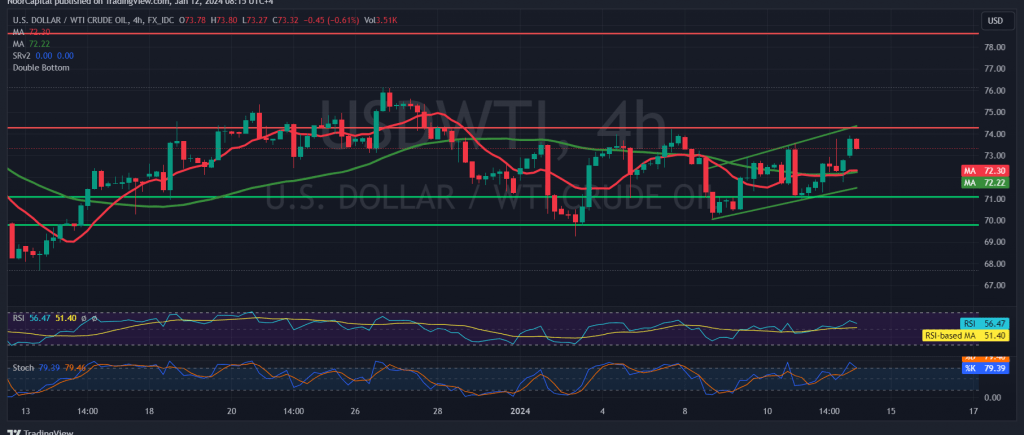

US crude oil futures exhibited mixed trading in the previous session, eventually returning to an upward trend after finding support around the pivotal level of 71.20.

From a technical standpoint, there is a cautious positive outlook. The price is receiving positive signals from the simple moving averages, which have provided upward support. Additionally, the Relative Strength Index (RSI) shows positive signs by maintaining stability above the 50 midline.

With daily trading persisting above 71.70, the potential for an upward trend exists, contingent on the price holding above the pivotal resistance level of 73.80. This would facilitate a move towards the first target at 74.45, followed by the next station at 75.50.

It is crucial to note that breaching 71.70 could halt any attempts at an upward move, leading the oil market into a bearish trajectory with an initial target at 70.10.

Warnings:

- High-impact economic data is expected from the American economy today, including the “monthly core producer prices” and the “monthly producer price index.” Additionally, the “monthly gross domestic product” indicator from the United Kingdom is anticipated, potentially leading to increased volatility during the news release.

- The risk level may be high amid ongoing geopolitical tensions, contributing to potential increased price volatility. Caution is advised in light of these factors.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations