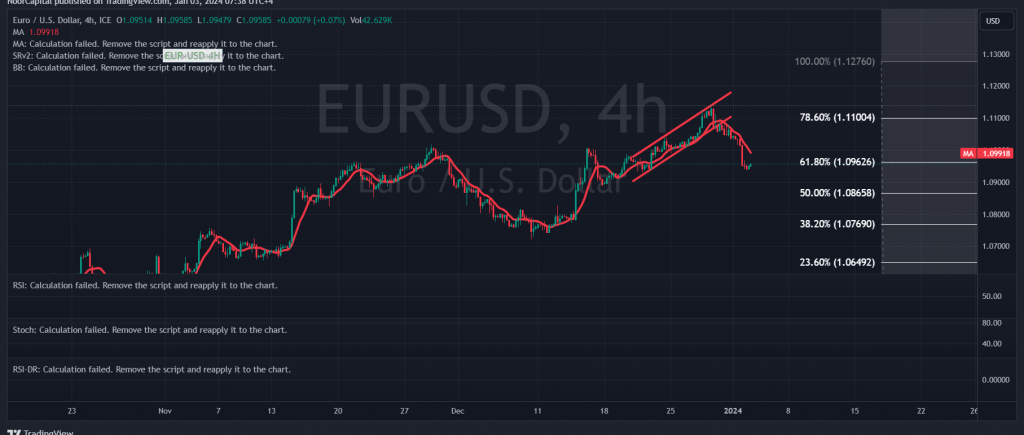

The EUR/USD pair experienced a significant decline in the previous trading session, aligning with the bearish expectations outlined in the earlier technical report. It touched the second target at 1.0960, marking a low of 1.0938.

From a technical standpoint today, a closer examination of the 240-minute time frame chart reveals that the price is generally stable below the resistance of the psychological barrier at 1.1000. The ongoing movements also indicate stability below the 1.0865 support level, represented by the 61.80% Fibonacci retracement. This is accompanied by negative pressure from the 50-day simple moving average.

Therefore, with stable trading below 1.1000, and more crucially, 1.1020, the prevailing bias leans towards the bearish side for the day. The initial target in this context is set at 1.0910, followed by 1.0865, which represents the 50.0% correction and serves as the next official support level.

It’s important to note that a upward jump and consolidation above 1.1020 would postpone the prospects of a decline. In such a scenario, recovery attempts for the pair could lead to a retest of 1.1085.

A cautionary note is warranted today as high-impact economic data related to the American economy (FOMC Minutes, ISM Manufacturing PMI, and JOLTS Job Openings) is anticipated. This may result in increased volatility during the release of these news items. Traders are advised to exercise vigilance and consider the potential market reactions to these events.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations