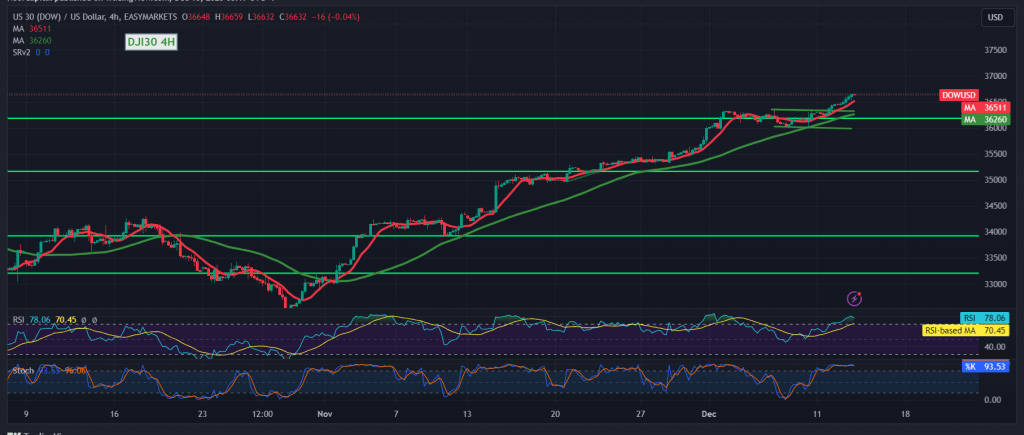

The Dow Jones Industrial Average has continued to realize gains, reaching the specified target outlined in the previous technical report at 36620 and marking its highest level at 36660.

From a technical perspective today, the 50-day simple moving average remains a positive motivator, providing support for the continuation of the upward trend. This is complemented by positive signals from the relative strength index.

Our inclination is towards a positive outlook, albeit with caution. This is contingent on maintaining trading above the support level of 36460. The initial target is set at 36740, with a breach acting as a motivating factor that could further enhance the likelihood of an ascent towards 36840. Subsequent gains may extend towards 37000.

Conversely, should the price slip below the support level of 36460, it puts the index under robust negative pressure, directing it towards a retest of 36290.

A word of caution: Today brings the anticipation of high-impact economic data from the US, including inflation numbers via the “Producer Price Index,” a Federal Reserve Committee statement, a Federal Reserve press conference, interest rate decisions, and economic forecasts. This may lead to significant price fluctuations at the time of the news release. Exercise prudence in navigating these potentially dynamic market conditions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations