Positive momentum characterized the Dow Jones Industrial Average’s movements at the commencement of the American trading session yesterday, reaching the initial target at the price of 36335 and attaining its highest point at 35353.

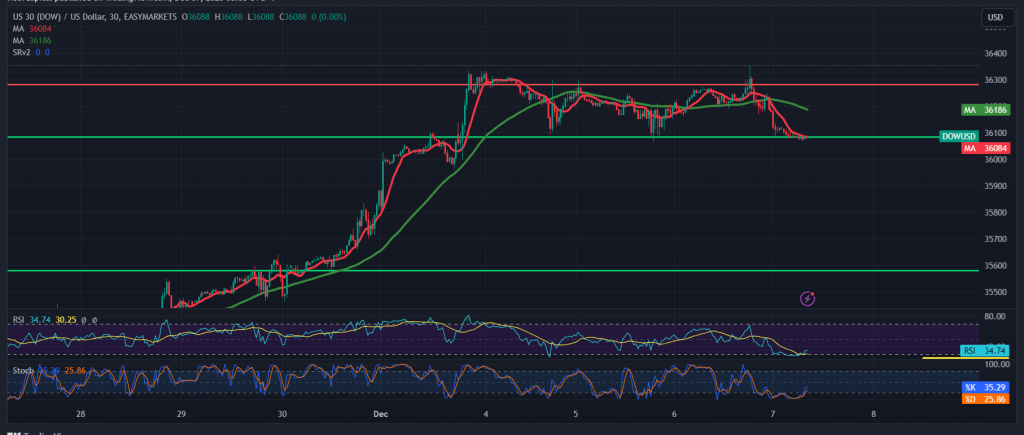

Today, from a technical perspective and upon closer inspection, the index encountered formidable resistance around 36350, prompting a shift towards negative trading. Indications of negativity are becoming apparent on the Stochastic indicator, accompanied by explicit negative signals on the 14-day momentum indicator.

Our inclination in the coming hours is towards a negative stance, particularly if the index slips below 36070. Such a move would facilitate a visit to 35985 as the initial target, and a subsequent breach could temporarily extend the losses, leading to an anticipated level of 35880.

It’s crucial to note that a reversal scenario may unfold if the index experiences an upward surge, consolidating the price above 36270. This development would thwart the proposed negative scenario, reinstating an upward trend with targets at 36450 and then 36550.

A word of caution: The risk level is elevated due to ongoing geopolitical tensions, potentially resulting in heightened price volatility. Exercise caution and stay vigilant.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations