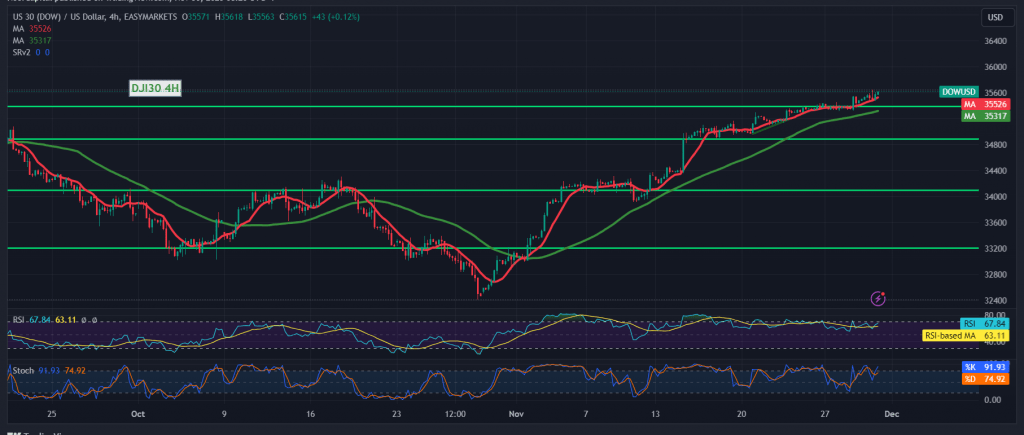

The Dow Jones Industrial Average succeeded in achieving the positive outlook as we expected, touching the official target required to be achieved during the previous technical report, located at 35640, recording its highest level of 35641.

On the technical side today, the simple moving averages continue to carry the price from below and are stimulated by the positive signals coming from the 14-day momentum indicator, which continues to provide positive signals.

Therefore, the upward trend is the most likely during the day, with intraday trading remaining above 35,500, targeting 35,680 as the first target, noting that breaching the aforementioned level is a motivating factor that enhances the chances of a rise towards 35,750.

Only from below is the return to trading stability again below the strong support of 3500. It postpones the chances of a rise, but does not cancel them, and we may witness a retest of 35370 before renewing attempts to rise again.

Warning: Today we are awaiting high-impact economic data issued by the US economy, the annual “Core Personal Consumer Expenditure Price Index.” We may witness high volatility when news is released.

Warning: The level of risk is high amid continuing geopolitical tensions, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations