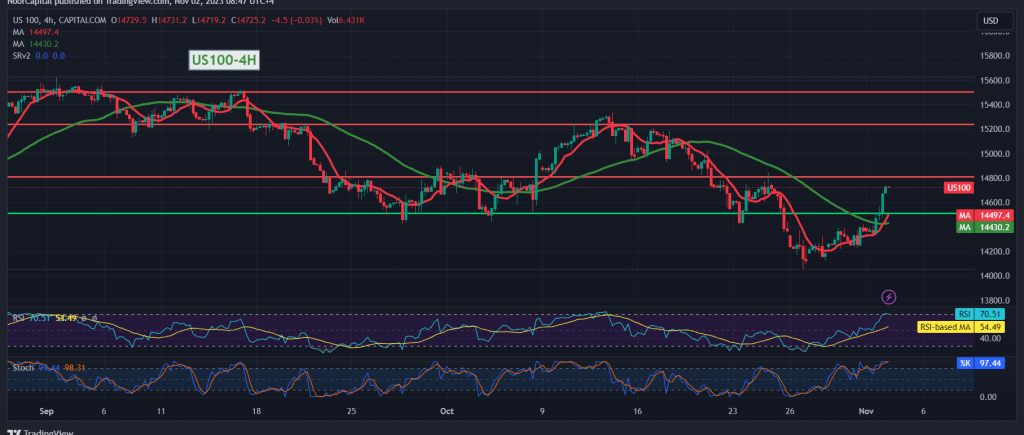

In our previous report, we maintained a neutral stance due to conflicting technical signals. We emphasized that activating buying positions would require breaching the resistance level at 14,420, paving the way directly towards 14,540, and potentially reaching its highest level at 14,738.

In today’s technical analysis, we observe positive signals from the Relative Strength Index, which remains stable above the 50 midline and is stimulated by the positive intersection of the simple moving averages. Consequently, there is a preference for an upward bias during today’s session.

If the index manages to breach 14,730, it could strengthen Noon’s upward bias, with an initial target set at 14,865. Subsequent gains may extend further towards 15,010.

It is crucial to note that slipping below 14,460 would negate the activation of the bullish scenario, subjecting the index to strong negative pressure and targeting 14,190. Traders should closely monitor these levels for potential trading decisions.

Please be aware that today, high-impact economic data originating from the British economy is anticipated, including the Bank of England governor’s speech, the interest rate decision, the monetary policy summary, the Bank of England’s monetary policy report, and the Monetary Policy Committee’s vote on interest rates.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations