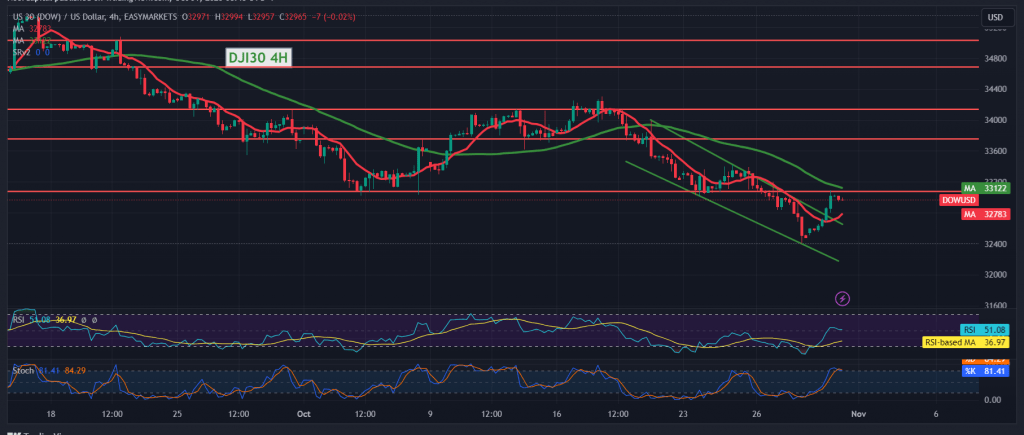

Positive momentum dominated the movements of the Dow Jones Industrial Average on the Wall Street Stock Exchange yesterday, capitalizing on the robust support level at 32,555. This enabled a breach of the resistance level at 33,710, suggesting a delay in the likelihood of a decline and steering the index toward positive movements. The target was set at 32,910, marking its peak at 33,092.

From a technical perspective today, the 50-day simple moving average remains a barrier to further gains. Conversely, the Relative Strength Index continues to uphold the upward trend initiated yesterday, coupled with intraday trading stability above 32,840.

During today’s session, we may observe a bias towards an upward trend, although caution is advised. Consolidation above 33,090 opens the path to visiting 33,185 as the initial target, with the potential for further gains extending to 33,210.

However, a return to stability below 32,840 would exert negative pressure on the index, potentially leading it back to the official downward trajectory. Initial targets in this scenario start at 32,645. Monitoring these crucial levels is essential for gauging the index’s future movements.

Please note that today, the market is awaiting significant economic data from both the US, including the Consumer Confidence Index, and Canada, particularly the monthly gross domestic product. When these news releases occur, there might be substantial price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations