As we expected from the previous technical report, the Dow Jones Industrial Average suffered significant losses in the last trading session. It touched the official target of 33,010 and recorded the lowest level of 33,015.

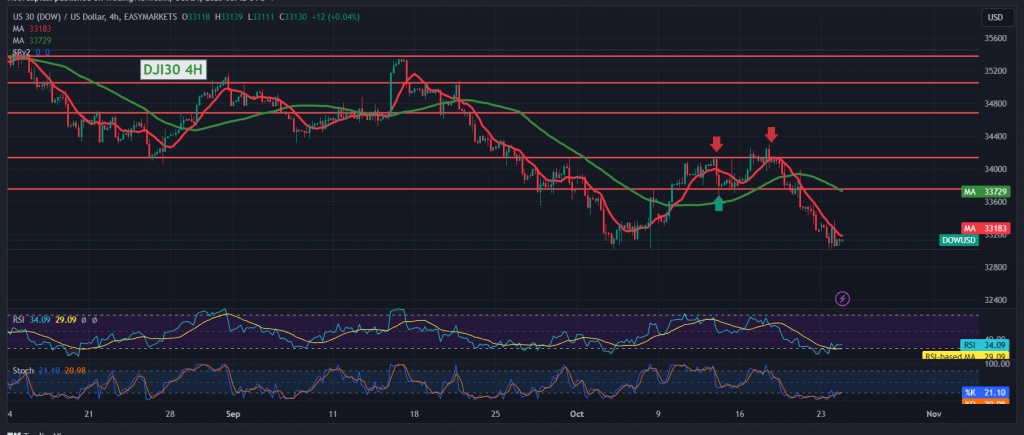

On the technical side today, with a closer look at the 4-hour time frame chart, with the continuation of the negative intersection of the simple moving averages, accompanied by the concentration of the Stochastic indicator around the oversold areas.

From here, with the stability of intraday trading below the resistance level of 33,360, the downward trend is the most preferred during the day, targeting 32,975 as the first target, and breaking it increases and accelerates the strength of the downward trend, as we wait for 32,820, the next station.

Trading stability return above 33,370 will immediately stop the downward trend and the index will recover with a target of 33,520.

Note: Today we are awaiting high-impact economic data from the Eurozone, the services and manufacturing PMI indexes from Germany and France, and the services and manufacturing PMI indexes and unemployment benefits from the UK.

In the US, the markets await the services and manufacturing PMI index, and we may witness some volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations