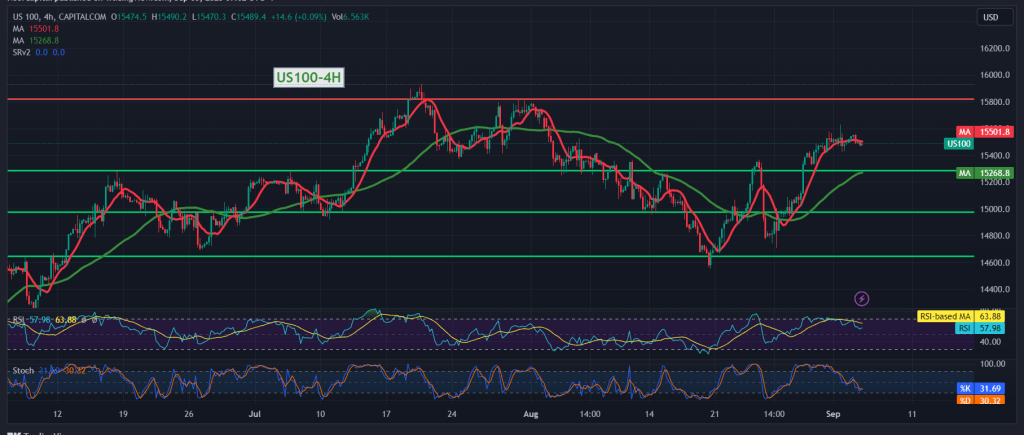

Negative trading dominated the movements of the Nasdaq index after several consecutive sessions of rise, recording its lowest level of 15,425 at the end of last week’s trading.

On the technical side today, we are leaning towards negativity in our trading, but with caution, relying on the stability of intraday trading below the resistance level of 15,580 and most importantly 15,600, in addition to signs of declining momentum on short time frames.

Therefore, the bearish bias is the most likely during today’s trading session, targeting 15,450 as the first target and then 15,400 as the next station; knowing that breaking it will extend the losses, we will be waiting for 15,310.

Activating the proposed bearish scenario requires trading to remain stable below the 15,600 resistance, noting that price consolidation above it will immediately stop the proposed scenario and the index will recover to retest 15710 and 15800.

Note: The risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations