Mixed trading dominated the movements of the Dow Jones Industrial Average on Wall Street, recording its highest level during the previous session’s trading at 34,676.

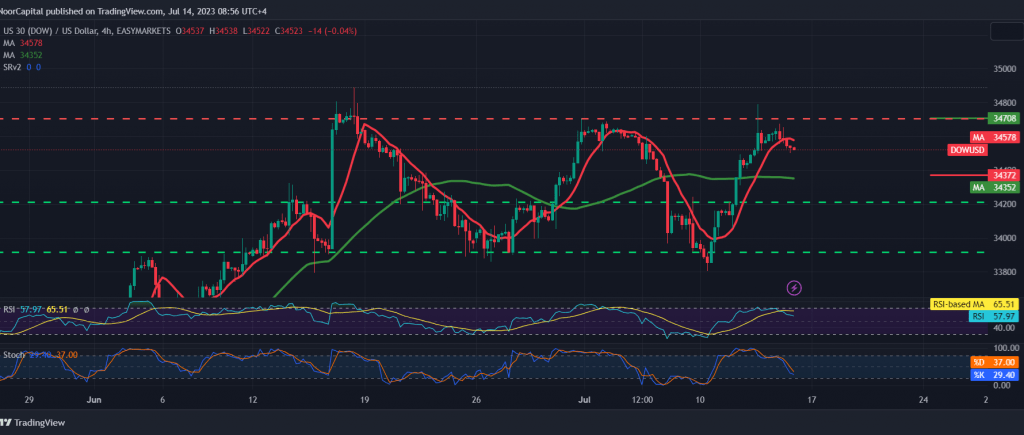

On the technical side today, by looking at the chart, despite the continuation of the move above the simple moving averages, we find that signs of negativity started to appear on the stochastic indicator, which supports the possibility of a limited bearish bias.

From here, with the steadfastness of intraday trading below the resistance level of 34,630, we may witness a bearish tendency that aims to retest 34,390 before starting the rise again, knowing that the bearish bias does not contradict the bullish daily trend, whose targets are located around 34,745 once 34,640 is breached.

Note: Today, we are awaiting high-impact economic data issued by the US economy, “the preliminary reading of consumer confidence,” and we may witness high volatility during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations