We adhered to intraday neutrality during the previous analysis due to the conflicting technical signals, explaining that activating buying positions depends on the pair breaching the 1.1000 resistance level, which leads the pair to recover, touching the pending buy order targets at 1.1080, recording its highest price at 1.1095.

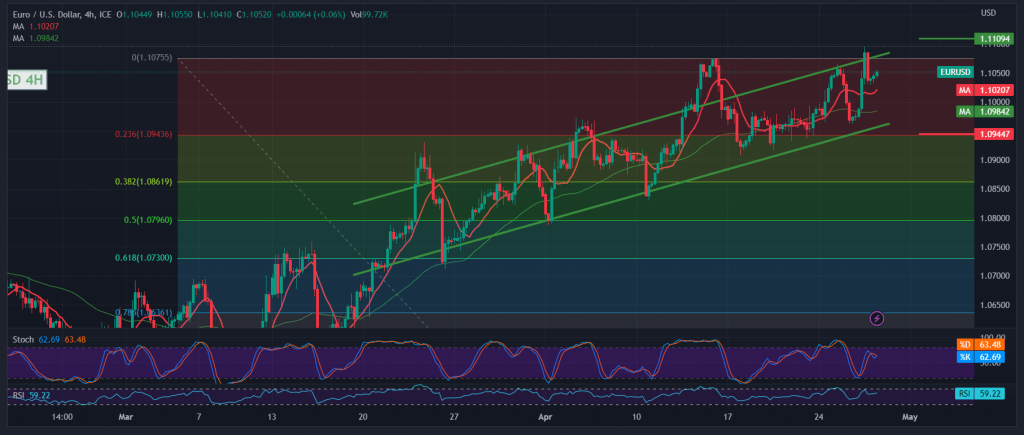

The technical side today indicates the pair’s liberation from the sideways range to succeed in stabilizing positively above the resistance of the psychological barrier 1.1000, which turned into a support level, with the pair continuing to receive a positive impulse from the simple moving averages that support the possibility of an ascent, in addition to the regularity of work within the bullish channel as it is. shown on the diagram.

We just need the price to consolidate above 1.1075, targeting 1.1110/1.1100 as a first target, and breaching it enhances the chances of the price heading towards the next target 1.1165.

From below, the price crept below 1.0980, which puts the price under negative pressure to retest 1.0945 23.60% Fibonacci correction before attempting to rise again.

Note: Today we are awaiting high-impact economic data issued by the US economy, “the estimated reading of the gross domestic product,” and we may witness price fluctuations at the time of the news.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations