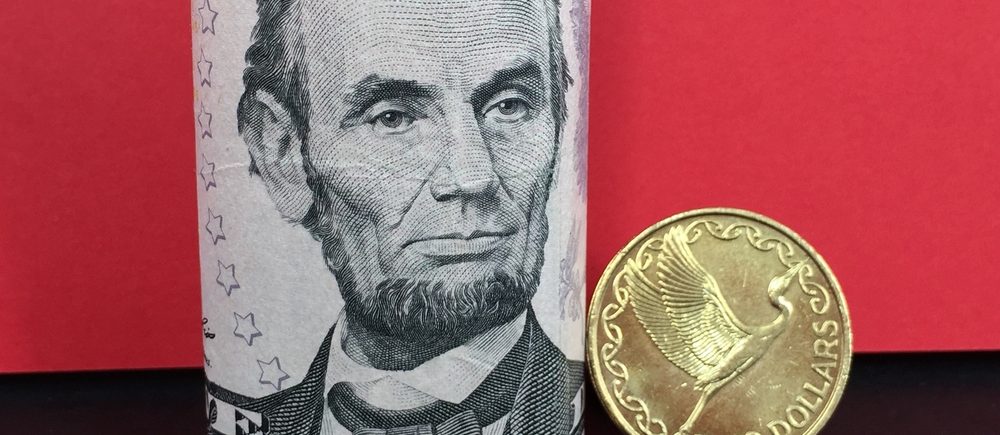

The US dollar index held firm on Tuesday, posting its biggest gain in two weeks, after strong US service sector data fueled expectations that the Federal Reserve would raise interest rates more than recently expected.

The Australian dollar rose from near a one-week low after the Reserve Bank of Australia raised interest rates for the eighth consecutive month.

The dollar index, which measures the performance of the US currency against six major currencies, settled at 105.24 after rising 0.7 percent on Monday, its biggest gain since November 21.

It fell as low as 104.1 on Monday for the first time since June 28 before turning around after data showed the US services sector unexpectedly rebounded in November as well as strong jobs data.

The Federal Open Market Committee issues its decision on monetary policy on December 15th. Dealers now expect a half-point increase in rates to a range of 4.25-4.5 percent and that the US central bank will stop raising interest rates at just above 5 percent in May.

The Australian dollar rose 0.3% to $0.6718, recouping some of its 1.4% losses on Monday, after the Australian central bank said it had no predetermined path to tighten monetary policy, but that inflation remained high.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations