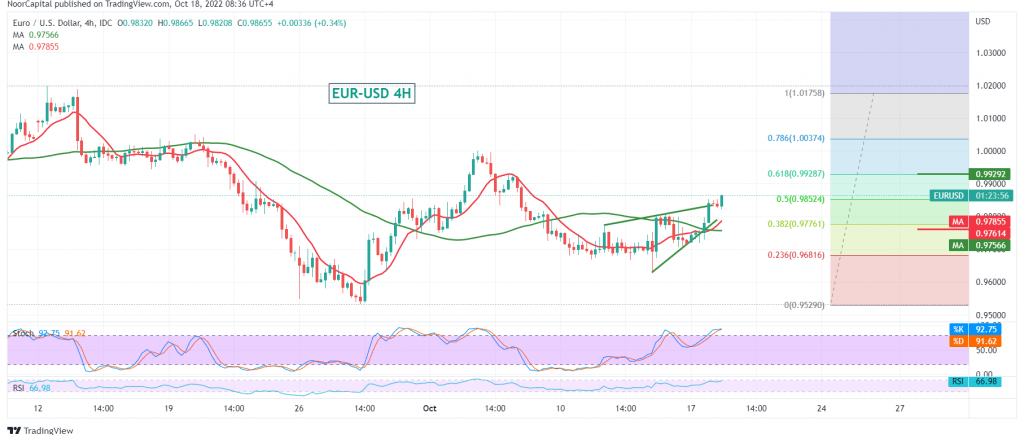

We adhered to intraday neutrality during the previous analysis due to a conflict in the technical signals, explaining that activating the buying positions depends on surpassing the upside level of 0.9780 in order to motivate the price to visit our first ascending target at 0.9845, recording its highest level at 0.9860 during the early trading of today’s session.

On the technical side, looking at the 240-minute chart, we find that the price succeeded in stabilizing above the 50-day simple moving average, which started holding the price from below, motivated by the positive signals from the 14-day momentum indicator.

Despite the technical factors supporting the possibility of continuing the rise, we witness a consolidation above 0.9850, 50.0% Fibonacci correction, to enhance the chances of rising to visit 0.9900, a first target, and then 0.9930, 61.80% Fibonacci correction.

To remind that activating the above suggested bullish scenario depends on the stability of daily trading above 0.9760, and breaking it will immediately stop the positive attempts of the euro against the US dollar and start the negative pressure to retest 0.9665.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9760 | R1: 0.9900 |

| S2: 0.9665 | R2: 0.9960 |

| S3: 0.9615 | R3: 1.0060 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations